Purpose of Finance: “creating money, channeling money, looking after other people’s money, sharing risk, and maintaining transaction and settlement systems

-Data on the efficiency of the financial system suggests that the ‘overheads’ which the industry extracts from society for fulfilling these functions have not reduced in over a century.

-we need to dig deeper to understand the ultimate purpose of finance: how it creates, deploys and facilitates the movement of money in a way that best enables us to achieve our goals, as individuals, as communities, and as a society

-If we want a financial system that meets its social purpose, we also need to take much more of an interest in the purpose of individual businesses within that system

…In this report, we argue for a new regulatory compass… we need to focus regulatory analysis and action on the social purpose of finance…. a provoking read by charity think tank, Finance Innovation Lab, Christine Berry et al. (2018)

“The experience of social purpose businesses in our community suggests that regulation – which is frequently assumed to be ‘purpose-neutral’ – is often designed around the large incumbent firms that dominate the market and are usually focused on profit maximisation. We explorethree challenges this raises.

The volume and complexity of regulation has proven extremely challenging for smaller, social purpose banks to comply with, since they do not have the same economies of scale or large compliance teams. Capital requirements are a particularly good example of how well-intentioned regulation designed around large incumbent banks can have unintended consequences for others. We argue that the Financial Conduct Authority (FCA) should launch a standalone Diversity Hub to complement its efforts to support innovation; likewise, the Prudential Regulation Authority (PRA) should offer additional support (including a sandbox) for firms that bring diversity to the banking sector, including new community and stakeholder banks.

The regulation of investment advice and product marketing is still relatively poor at recognising social and environmental investment objectives. The shift to automation risks exacerbating these problems – particularly if machine learning techniques use historical data that reproduce historical biases that no longer reflect society’s views.

We argue that the FCA should adopt a human-centred approach to regulation, starting from the perspective of a person who has a range of objectives for their finances, rather than assuming maximum financial return is the sole aim.

Regulatory approaches to innovation tend to focus on technological developments, to the detriment of other forms of innovation, particularly new business models centred on social or environmental purpose. The authorisation process can be especially challenging for these types of firms; often the unique risks of social purpose models are considered, but not the unique benefits. We argue that regulators need a framework for thinking about the societal challenges we want innovation to solve – and thus the kinds of innovation we want to support – rather than focusing solely on increasing competition through technological innovation.

Three regulatory fallacies

We identify three fallacies that permeate current regulatory thinking:

-The fallacy of composition (if every unit in the system works, the whole system works)

-The fallacy of neutrality (current regulatory approaches are values-free and any changes to this would mean taking an unjustified moral stance)

-The fallacy of market efficiency (competition and ‘market integrity’ are effective proxies for the outcomes we want the financial system to serve).

We can either transfer these flawed assumptions to a new regulatory regime, or take this opportunity for a deeper reconsideration of how we regulate financial systems....

Comment: Given the incremental and evolutionary nature of regulation, these ideas are in the "thought-provoking" but ultimately not practical at this point in time, Although, to some extenet, that's the point of think-tanks.

Further, the report is very UK focused, while being aligned to the organisations purpose, it somewhat underappreaciates or ignores the global interconnectedness of regulation and particularly with respect to financial regulation. There is regulatory arbitragage which governments are aware of.

The report makes several provoking suggestions to regulators, however I feel many of these recommendations sit somewhat outside of regulators current mandates and if such "purpose" wants to be met, then it needs to start at government level preferably led by society demand.

As to the suggestions themselves, I do think it's interesting going back to thinking about the social purpose of finance and how that can be made better, but I do not have any clear answers here. I do think (as I have referrred to previously) the very eloquent work (althiough not necessarily "correct") of Milton Friedman in the 1970s has perhaps not been answered as eloquently by critics, although certainly the stakeholder model (eg see Amir-Zadeh) can answer it.

In any case, I am no expert in matters of policy or macroeconomics, so wil leave it to bigger brains than me to solve.

The current Arts blog, cross-over, the current Investing blog. Cross fertilise, some thoughts on autism. Discover what the last arts/business mingle was all about (sign up for invites to the next event in the list below).

My Op-Ed in the Financial Times (My Financial Times opinion article) about asking long-term questions surrounding sustainability and ESG.

Some popular posts: the commencement address; by Nassim Taleb (Black Swan author, risk management philosopher), Neil Gaiman on making wonderful, fabulous, brilliant mistakes; JK Rowling on the benefits of failure. Charlie Munger on always inverting; Sheryl Sandberg on grief, resilience and gratitude.

How to live a life, well lived. Thoughts from a dying man. On play and playing games.

A provoking read on how to raise a feminist child.

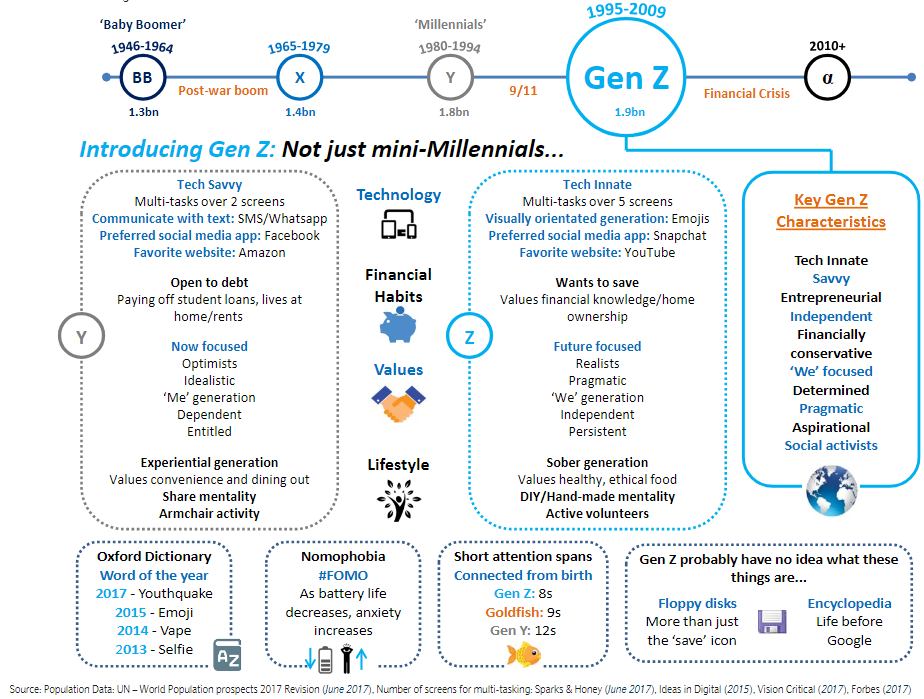

An examination of the Generation Z cohort and how they differ from Millennials.