How should short selling account for carbon? Does selling short impact cost of capital or engagement ? My friend Jason Mitchell discusses various views and in particular how regulators have started to think about carbon accounting with hedge funds.

We started talking about this in a podcast a while ago (link end), and you can now read some collected thoughts in the paper which is now publicly available.

Summary:

- Sustainable finance regulation has largely overlooked alternatives, particularly hedge funds, given the greater complexity of strategies and asset classes. However, regulators are now expanding their scope to recognize the role that hedge funds can play in #sustainable finance.

- The role of short selling in sustainable finance, especially in a net zero context, has been increasingly discussed and debated among regulators, market participants, investor initiatives, investor trade organizations, and #ESG data providers. There is a concern that hedge funds may, intentionally or unintentionally, employ short selling to misrepresent their real-world impact, which is distinct from exposure to financial risk.

- Short selling can affect the cost of capital and engagement as channels of influence on corporate behavior. However, there are nuances that should be considered, namely the efficacy of short selling among different asset classes to affect the cost of capital, the time-varying aspect of short selling, and the limitations that short sellers face when engaging corporates.

- UK, US, and EU regulators have each signaled their leaning in different manners. The EU, as the regulator with the most mature regulatory framework, appears to establish a compromise that balances safeguards against greenwashing with the mechanics of portfolio management and reporting.

Zeke Hausfather: state of climate science, energy systems, post COP26, tipping points, tail risks | Podcast

Zeke Hausfather is a climate scientist and energy systems analyst whose research focuses on observational temperature records, climate models, and mitigation technologies. He spent 10 years working as a data scientist and entrepreneur in the cleantech sector, where he was the lead data scientist at Essess, the chief scientist at C3.ai, and the cofounder and chief scientist of Efficiency 2.0. He also worked as a research scientist with Berkeley Earth, was the senior climate analyst at Project Drawdown, and the US analyst for Carbon Brief. Follow his Twitter for his climate thoughts.

We discuss:

What is most misunderstood about climate science today.

Why many doomsday scenarios are unlikely but yet serious damage from climate is happening now.

Why scientists have been poor in communicating what is mean by tipping points with respect to climate.

How he thinks about climate “tail risk” and how tail risk diminishes the less heating happens.

The problems with “averages” and how there is uncertainty not only about our amount of emissions, but the sensitivity of the climate to our emissions.

Why climate is better thought of as a gradient rather than point thresholds.

The problem with climate economics due to time horizons, long time horizons and the discounting models economists use.

Zeke’s thoughts on the range of different projections coming out post COP26 and what they mean. (Article link here)

Zeke’s view and under-rated/over-rated on:

degrowth

carbon tax

techno-optimists

nuclear power

carbon offsetting

divestment movement

gas as a transition fuel

green New Deal

Bjorn Lomborg

Zeke finishes with advice for people who want to be involved in climate.

Listen to the podcast below or in your favourite podcast app. Transcript below.

PODCAST INFO

Spotify: https://sptfy.com/benyeoh

Anchor: https://anchor.fm/benjamin-yeoh

Zeke Hausfather Transcript (transcript is only lightly edited and not fully proof read for typos and errors)

Ben Yeoh (00:00): Hey everyone, I’m super excited to have Zeke Hausfather speaking with me today. Zeke is a climate scientist, so we're going to get all into climate. Zeke, welcome!

Zeke Hausfather (00:15): Thank you. It's great to be here.

Ben Yeoh (00:17): So, what do you think is most misunderstood about the state of climate science today. I guess I read a lot of stuff about what previously was thought of as business as usual. A lot of people referred to this kind of rcp 8.5 and it seems to me that the consensus of climate scientists is probably saying that that's not likely to happen as the kind of central case but I don't know whether what you thought about what maybe most misunderstood or perhaps most being challenged at the moment.

Zeke Hausfather (00:52) Sure. It's always hard to communicate all the nuances of climate science to a general audience. It's a very complicated field. The earth is an incredibly complicated system and there are a lot of big uncertainties in how the climate responds based on our emissions and so with that said, there are sort of two areas where I think there are often common misconceptions around climate. One is the extent to which climate change is inevitable. So, one area where there has been a lot of progress in recent years and this is something that was featured fairly heavily in the most recent intergovernmental panel on climate change report or IPCC report, is this question of how much warming is in the pipeline; how much warming is locked in today based on our past emissions of greenhouse gases.

Zeke Hausfather (01:42): What's interesting is that previously there was a fairly widespread understanding that a certain amount of warming was locked in, and that's based on the fact that if you were to keep the amount of CO2 in the atmosphere constant for the next 100 years or so, you would indeed have another half a degree or so of warming on top of what we've already had today. The reason for that is because the oceans buffer the rate of warming of the earth's surface. Water can absorb an enormous amount of heat; upwards of 90 percent of all the heat being trapped by greenhouse gases today is going into the oceans and so the earth has warmed up considerably less than it would if it didn't have these oceans that are absorbing a ton of the extra heat that's being trapped by greenhouse gases.

Zeke Hausfather (02:24): So, because of that, at current levels of greenhouse gases, as the oceans continue to heat up the surface will also continue to heat up but the important part of that and where it leads to some confusion is at current levels of greenhouse gases. Now the amount of greenhouse gases that are in the atmosphere depend in part on our historical emissions of greenhouse gases but also in our future emissions and so if we can actually get co2 emissions, in particular, all the way down to zero then the amount of co2 in the atmosphere doesn't stay flat it actually starts declining and the reason for that is because the oceans and the land is absorbing some of the co2 emitted in the past on an ongoing basis. The system will eventually reach a new equilibrium which will be higher than it was before we started emitting co2 but there still is a decent amount of co2 currently in the atmosphere that will be absorbed by natural sinks if we can get co2 emissions to zero. It turns out that the cooling that would cause falling levels of co2 in the atmosphere due to absorption by land and ocean carbon sinks is almost perfectly balanced out by the additional warming you get as the ocean come up to an equilibrium with the atmosphere and so the [Inaudible: 3:36] and across many different earth system models that we've run is that once you get co2 emissions all the way down to zero, global warming stops and that's good news and bad news.

Zeke Hausfather (03:46) The bad news is, the earth does not cool back down, at least for many centuries to come once we get emissions to zero. So, we're sort of stuck with whatever level of warming we had when we finally get to net zero emissions. The good news though is that it means there's not any amount of warming that's inevitable. We can control how much warming we end up experiencing by when we get to net zero emissions. Now, I should note that there is some warming inevitable not for physical reasons but for economic reasons simply because we can't wave a magic wand and get all of our emissions to zero tomorrow. We're probably not going to be able to get global co2 emissions to zero before 2050 and so there's probably going to be about half a degree more warming simply because we can't reduce emissions fast enough due to technological and economic reasons but from a climate system perspective there's no additional warming that we experience once we get emissions all the way to zero. So, that's an area that I think we can help clear up some misunderstandings around and that is potentially pretty empowering for folks because it means we ultimately have control over the degree of warming that the earth experiences.

Zeke Hausfather (04:53) Then the other area which you sort of teed up earlier is around where we're headed in terms of emissions. About a decade ago, which is when the previous IPCC report came and a little before that in particular when the previous generation of emission scenarios were being created by researchers, it seemed we're in for a pretty dark climate future. Global emissions have increased by 30 percent over the 2000s and were increasing by three percent a year. Global coal use had almost doubled. China was building a new coal plant every three days and the idea that the 21st century would be dominated by coal and we could end up with doubling or even tripling emissions by the end of the century didn't seem that far-fetched and so

those were scenarios where scientists thought we could end up at four or five C warming.

Zeke Hausfather (05:42) Flash forward about a decade and we're in a very different world right now. Global coal use peaked back in 2013 and the IAA has recently estimated that it's in structural decline going forward. Clean energy like wind and solar is the cheapest new form of energy of the margin in many places around the world and global emissions have been relatively flat for the last decade. Fossil fuel emissions have been increasing by only about one percent compared to three percent for the prior decade and emissions from land use, according to our most recent estimates, have actually been slightly decreasing. Mostly balancing out the increase in fossil fuel use. So, it seems like the world is now entering a long plateau in emissions rather than continuing increasing emissions driven by a combination of falling clean energy prices and governments enacting stronger policies to actually start dealing with climate change in a much more meaningful way than they were a decade ago.

Zeke Hausfather (06:36) Now, flat emissions still means that the level of co2 in the atmosphere is increasing. In fact, flat emissions means that the rate of warming stabilizes. So, the world keeps warming at not 0.2 C per decade rather than the warming accelerating, which is still not a very good outcome. We don't want warming to continue at its same pace. We want warming to slow down and ultimately stop and for that to happen we don't just need to flatten our emissions; we need to get them all the way down to zero. But this flattening of emissions means that the world we're heading toward right now is probably one of around three degrees warming or a little below three degrees under policies in place today rather than the four or five degrees that seems plausible a decade ago and that's good news. A three-degree world is certainly still not one we want to live in. It would have catastrophic impacts for some human and natural systems and the world doesn't end in 2100 even though our models do. The world of flat emissions after 2100 would still reach 4 degrees by 2150 and potentially even 5 degrees by 2200.

Zeke Hausfather (07:38) So, it doesn't change the fact that we ultimately need to get emissions down to zero. But it is good news and it means that it's much easier to envision a world where we sort of further bend the curve of emissions down to meet Paris agreement goals of limiting warming to well below two degrees than it was in a world where we were still headed for four or five degrees warming. So, I think that's been a really big change over the last few years a really big realization by the sort of climate science and energy modeling community and it has led to us starting to focus a bit more in terms of the impacts of a three-degree world rather than a four- or five-degree worlds that we tended to focus on a lot in the last decade.

Ben Yeoh (08:19): Okay, that makes a lot of sense. It's a kind of nuanced message actually from climate science because on the one hand you don't want to play down the fact that these are serious risks and we need to take them very seriously because you still have climate denial and people who are not. On the one hand you also don't want to say that actually those doomsday scenarios which were actually looking plausible 10 or 20 years ago are no longer looking so plausible, because from my view you often get these people who have what I would call learned-helplessness. If you think you're going to be doomed then you kind of do nothing and you see some of this in surveys where you're saying “oh some children are thinking it's doomsday and so why should we try anything?” So, it's kind of like we need to take them seriously but actually we have done a lot of progress in 10 years. Is that kind of a reasonable summation of what something is a little bit more nuanced?

Zeke Hausfather (09:15): I think so. It's important to emphasize that we already are seeing dangerous effects of climate change today; at 1.2 c in global warming. Where I live in California, we now have a smoky season and a fire season because every year we're seeing worse and worse catastrophic wildfires. We've seen extreme heat waves beyond anything people predicted in the pacific northwest earlier this year, flooding across Europe and China and parts of the U.S. We're really already starting to see climate impacts in a big way where we are today and so if you double that amount of warming or more than double that amount of warming too close to three degrees, it's not a world we want to live in. It's not one that's probably the end of the world or like the end of the human civilization or anything quite that dramatic but it certainly is not a world we want to leave to future generations.

Zeke Hausfather (10:08): It's also worth emphasizing that our emissions are only one of three different uncertainties that we as scientists grapple with when we're trying to figure out how the planet will warm in the future. The other two are the sensitivity of the climate to our emissions, so essentially how much warming do you get as the amount of [green house gases] increases in the atmosphere and the reason that is uncertain is because there's lots of different feedbacks of the earth system. So, as the planet warms you have more evaporation, you have more water vapor in the atmosphere that can stay there before it precipitates out, water vapors, greenhouse gas, it enhances the amount of warming we get, you have melting ice sheets and sea ice that reveal darker surfaces underneath that absorb more of the sun's rays and change what we call the albedo of the planet. You have changes in cloud formations that depending on how they interact, can either lead to more or less warming and so none of these things are known precisely. We have a good understanding of many of them, but it still means that when we're trying to estimate how much the climate will warm as a result of increasing co2 in the atmosphere, we end up with this range and we've narrowed that range in recent years but it still has a range.

Zeke Hausfather (11:14): For example, in the most recent IPCC report we said that if we double the amount of co2 in the atmosphere and wait till the system reaches equilibrium as the ocean warms up to match that we'll end up with somewhere between 2.5 and 4 degrees of warming. That's sort of our likely range, so one sigma if you will, the two-sigma range is, I think two to five degrees warming and so we still don't know precisely where in that range we’ll land and then the other uncertainty we have to deal with is what we call carbon cycle feedbacks. So, right now when we emit co2 into the atmosphere about half of it or a little bit more than half that actually is absorbed by the oceans and the land and that's a really good thing. Climate change would be more than twice as bad if the earth was not absorbing some of the emissions that we're putting up today but the ability of the earth to absorb those emissions, the ability of the ocean to keep taking up some of our extra co2, the ability of the land to increase forested area, increase leaf size as a response to just a quest for more co2 in the soil. All of that can be affected by the warming of the planet.

Zeke Hausfather (12:19): For example, when the oceans become more acidic as they're absorbing co2 that can actually decrease the ability of surface waters to absorb more co2 from the atmosphere. Similarly, as the land warms, we see more catastrophic wildfires as we're having here on the west coast. We see more soil moisture evaporation which can lead to carbon loss from soils and so we expect the ability of the biosphere and the oceans to absorb our extra emissions will decrease as the earth warms. Exactly how much, however, is a little bit uncertain. So, when you put together those different uncertainties, even though we say we're on track for a world of just under three degrees warming today under current policies, we can't rule out the chance that that might be 40 degrees warming instead. It might only be a five percent chance we end up at four degrees under current policies today but that’s a pretty big risk to take and so it's not just the central warming estimates that we should talk about, even though we tend to focus on them a lot. It’s these tail risks that can really dominate the potential impacts because the damages associated with climate change are very non-linear. Three degrees is much worse than two degrees, four degrees is much, much, much, worse than three degrees across many different systems.

Zeke Hausfather (13:33): Finally, I should mention that when we talk about these global average warming levels, we're doing ourselves a little bit of a disservice. No one lives in the global average. In fact, the global average is mostly oceans and on the land areas where we all live, the rate of warming we've experienced has been much higher. In fact, over the last 150 years the land areas have warmed about 50 percent faster than the world as a whole and almost twice as fast or 70 or so percent faster than the oceans and so even though the world as a whole has warmed by only about 1.2c since pre-industrial times, the land areas on average have warmed by about 1.9 degrees and we expect that difference to continue as the world warms. So, that means a three-degree c future is really a four and a half degrees c future on average of the land areas where people tend to actually live and even more than that in high latitude areas. So, you can start seeing some really big changes associated with these. What seems at least when you hear them are relatively modest changes in the global mean. I like to use to ground myself on this like the last ice age which I think everyone would recognize as a very different planet than we have today. It was only about five to seven degrees c cooler in terms of global average temperatures than our current climate today and so we could end up sort of half an ice age unit difference in warming under current policies or more by the end of the century which is a huge change for our planet.

Ben Yeoh (15:08): Sure. I mean that puts a lot in perspective, that’s risen so many questions in my head which is great. So, I work a lot with models and we kind of know that every single model is always wrong so I sometimes get a bit worried about this point estimate. I think the things you sort of said are actually giving us a slight guide to something which is quite complex. One question which comes up that I’m asked is what are the chances of a kind of feedback loop which gets too so-called I guess people call these tipping points but something which is so bad that we kind of end up in another kind of another kind of phase. My reading of the literature suggests that within a say at least a three-degree band sort of the tipping points which would seem to be very catastrophic that some people talk about, don't seem to be likely. I’m not sure if I’ve read that properly and then are there tail risks on either side of that and then my second one on the tail risks is, I guess this is on the slightly hopeful as well as the other side is I can't tell and there seems to be things about how symmetrical or not these tell risks are and I guess people don't really know but is it plausible that we could also hit some really good things as well as some really bad things although I guess the good things are more likely to come from innovation breakthroughs but they I might also happen on the landmark side. Maybe I’ll stop there because I’ve got something about the differences also and the fact that it's not equal over the land mass either.

Ben Yeoh (16:39): Some places are going to be really hit hard and actually some places might even do a little bit better which is one of the really difficult things to grapple with across the whole globe but maybe the first one is yeah, this idea on tipping points is a kind of tipping point risk to the downside likely within a three degree or four-degree sort of range or what's your view of the reading of the science yeah

Zeke Hausfather (17:01): So, tipping points is an area where I think we as a scientific community have not done a great job of communicating to the general public because when people think of tipping points, they think of sort of everything is fine. You suddenly pass a point where everything falls apart, we go to hell in a handbasket of runaway global warming, the earth becomes Venus, the oceans evaporate. Wow it’s us, that's not going to happen but at the same time there are real points where you start to see big changes, particularly to specific ecosystems and I think the story around tipping points is less a global snowballing of climate change then the more a series of very impactful regional effects that can happen as the earth warms. Some of them then contribute to additional warming going forward. Some tipping points that we have a lot of confidence about are things like coral reefs, so coral can only generally survive in a fairly narrow temperature band that's adapted to. Corals can evolve over time but the rate of change we're seeing right now is much faster than has been experienced in much of the earth's history and so if you have more than 1.5 to 2 degrees warming most reefs in the world are going to be gone and reefs provide a huge benefit to fisheries, to coastal protection, tourism revenue for islands uh there's a lot of really negative impacts uh when coral reefs disappear uh and at 1.5 degrees many of them are in great peril and at two degrees most of them are gone barring a few specific locations that have unique characteristics like cold water upwelling or other things that can lead the reefs to be more preserved.

Zeke Hausfather (18:38) A similar type of regional effect is that areas of the Amazon that are already under a lot of pressure from deforestation. With a two degree plus warming world could start to transition into more of a savannah type ecosystem, it could be tough to restore back to a tropical rainforest in the future and that’s due to the interaction of climate change and deforestation and so by tackling either of those you can reduce the risk of that but certainly you could see some sort of ecosystem phase shifts like that. Similarly, Boreal forests are subject to a lot of stressors. Wildfires are going to reach further and further north as the world warms. Vegetative cover is going to change in those regions which can have big effects on the local climate there. There are potential changes in monsoon patterns that are a lot more uncertain. There's a slowdown of the thermohaline circulation that's been observed that's projected to continue even if an abrupt collapse seems unlikely and that can have a big effect on regional rainfall patterns. It can actually lead to some regional cooling in parts of northern Europe though that would be overwhelmed by the longer term warming we'd experience in that world. So, you'd have a bit less warming in those regions. Arctic sea ice is likely to disappear in the summer around 1.5 degrees or a little below which kind of has big effects on the ecosystems there and then, the permafrost in the arctic. So, there's an enormous amount of carbon and sort of vegetative matter in the soils that's frozen in the north and as those regions warm those start to melt and release methane and carbon dioxide.

Zeke Hausfather (20:11): Now in most cases these are somewhat gradual processes so it's not like you reach a certain point and suddenly there's the methane bomb and all the methane and carbon dioxide from permafrost goes up in the air at once. It's more the lower latitude areas start falling faster than the higher latitude areas south facing surfaces thought faster than north facing surfaces and so you get a more gradual response than the popular conception would lead you to believe but importantly a lot of these systems that we call tipping points are characterized by hysteresis and what hysteresis means is that once you start changing it, it's much more difficult to reverse it so ice sheets are good example here. There's a lot of ice sheet dynamics where you could have very rapid ice sheet loss in places like Antarctic and Greenland as the world warms and you'd have to cool temperatures back well below pre-industrial levels to get most of those ice sheets back once they’ve started to disintegrate so again it's less about a cliff we fall off and more a slippery slope we start going down. The net effect of all these changes is going to have a lot of big regional impacts. It's going to lead to some long-term additional global climate change due to things like more CO2 emissions and to a lesser extent methane emission but because the methane is slowly emitted the CO2 effect is much bigger from permafrost. Changes in albedo associated SIS los though a lot of that is already included in our models and our future projections but a few of these tipping points that we've identified really have the likelihood to lead to a substantial amount of additional warming beyond what is already in our models today at least in worlds that warm say three degrees or less.

Zeke Hausfather (22:11): It becomes a little bit more challenging to project exactly what will happen once we start getting beyond that. The last interglacial period was probably about a degree warmer than where we are today so a little under three degrees and we didn't see obviously C levels are 80 meters higher or whatever than they were today we saw some very long-term major earth system changes. But we didn't see any sort of runaway temperature change or very large temperature feedbacks in the last interglacial and so that kind of gives us a reasonable amount of hope that we're not going to see similar types of very large changes at under three degrees warming. Once you get past that you sort of get more into the world of the unknown. You're in a climate that is sort of unprecedented at least for the last three to 12 million years and then the odds of bigger surprises become larger.

Zeke Hausfather (23:04): An example of this is there's a paper by Tapio Schneider and his team at Caltech a couple years back where they looked at what happens under very high warming scenarios so say a world of 1200 parts per million co2 5c warming above pre-industrial and what they found is that beyond a certain point you start losing much of the stratocumulus cloud decks that cover the world's oceans over the course of a few years and that leads to another 6c warming on top of the 5z warming you already have over the course of a decade or two. That's the sort of catastrophic tipping point. Now obviously that was a very simple model that didn't have global coverage and there's a lot of scientific debate over how accurate those sorts of things are but the odds of those sorts of surprises become notably higher in a world of four or five degrees warming than the worlds under three degrees warming. It's a very good incentive to try to limit warming as much as possible. They're also and I should mention this because I think it's an important point, as we reduce our emissions the tail risks fall faster than the mean risk. That is to say the odds of four degrees warming fall faster than the odds of three degrees warming where sort of the 95th percentile of warming outcomes falls faster than the 50th percentile which is good and it means we can minimize these tail risks by reducing our emissions in a way that's important.

Zeke Hausfather (24:34): As to your other question about good surprises, certainly when we talk about uncertainties in the climate system, like climate sensitivity and carbon cycle feedbacks, those uncertainties work both ways. We run our models based on; at least for carbon cycle, feedback, the central estimate and the models themselves of a wide range of client sensitivities but it certainly is possible that we could think we're in store for a three-degree world and end up in a two degree one. Just like we could think we're in store for a three-degree world and end up in a four degree one. The challenge is that because the damages of warming are so asymmetric, that risk of four degrees influences our calculus in a way that's much more important than a risk of getting lucky and only ending up two degrees. So, when it comes to climate change uncertainty is decidedly not our friend even if it means we could get lucky and end up beating our climate goals when we don't expect to.

Ben Yeoh (25:30): Yeah, okay. That makes a lot of sense.

Zeke Hausfather (25:32): I’m sorry, I forgot your last question.

Ben Yeoh (25:33): Well, we have referred to it a little bit. It was the downsides of having just point estimates and I partly think of that because I had a couple of people tell me “oh if we don't hit 1.5 like well that's it then isn't it” and this is idea of like no actually 1.6 is better than 1.7 and it's better than 1.8 for the reasons that you give because not only is your mean temperature down but your tail risk has gone from being fat tails to hopefully thin tails or non-existent tails so that everything matters and the kind of the simplicity of the message of a number I can see has really resonated and has got people through. But, then that has partially overclouded some of the nuance which is then led to these kind of interesting other kind of debates and I didn't really know whether we’re to pull down on it except that it did seem that some people and I guess some people not in good faith but then some also in good faith are slightly just misinterpreting about how you can use a point estimate because you need to use it in the context of everything else and that doesn't go easily within a tweet or something like that.

Zeke Hausfather (26:45): Yeah, okay. So, what I like to say is that climate change is ultimately a matter of degrees rather than thresholds. There are no specific points that we know of where things go from fine to bad or bad to catastrophic. It's a gradient and that's true across most of the things we consider tipping points for that matter. There's not a single point where the system goes from fine to bad. It gets progressively worse with more and more hysteresis in some of these systems I think it's a bit of an unfortunate side effect of the way that we've created these global climate targets that they've become interpreted by a lot of people as thresholds, whereas in reality they are somewhat arbitrary constructs. We have a lot of literature about how two degrees is worse than one point five degrees and three degrees is worse than two degrees. But again, it doesn't go from there's none of these impacts to suddenly there's all these impacts when you pass 1.5 or when you pass 2.5. They're all getting gradually worse between those and so we really need to try to emphasize to people that every tenth of a degree matters. That even if we can't limit warming to 1.5 degrees which, if I’m going to be perfectly honest, we're not going to limit warming to 1.5 degrees and we can dive into that in a little bit if you want, it doesn't mean the world's going to end, it doesn't mean we should give up hope. It means it's all the more important that we limit warming to 1.6, 1.7, 1.8, wherever we can get that isn't three degrees or four degrees.

Zeke Hausfather (28:07): Again, part of that is around the minimization of tail risks because a best estimate of 1.8 could be 2.5 degrees if we're really unlucky with some of these climate system uncertainties. So, the further we can bring that point estimate down, the more we're minimizing these tail risk outcomes.

Ben Yeoh (28:25): Sure, that makes a lot of sense. We'll come back to your 1.5 and maybe also to cop 26 as well but one extension of this which I was intrigued from your view because it's a little bit further along from your work is what I would call climate economics and to tell you the truth I haven't been super impressed by some of the economics papers but maybe that's because I also don't really understand what they're trying to say. Some of the economics suggest, when they try and pass this into something like GDP, that you're talking about kind of a 10 percent impact on GDP or global GDP which is actually quite a lot but kind of seems manageable particularly if you mitigate and adapt. But it doesn't seem to have accounted for some of the things that you've talked about like localized tipping points or the fact that some countries might be completely devastated that that falls unequal on the world. Plus, when I look at their models, I’m just like well there's so many assumptions in there. I just feel it's even more uncertain than where we've got from some of the climate model stuff which actually in essential scenarios and a lot of you guys are doing the modeling kind of agreeing about where we're pointing. Whereas, that doesn't seem to be when they're trying to translate that into the kind of economics part. Do you have any view on how it's translating into economics or how climate economics are thinking about this?

Zeke Hausfather (29:49): Climate economics is a challenging field because you're looking at such long-time horizons and such big uncertainties, both in terms of how the climate will change but also in terms of how our societies will change. I think it can be instructive at times, but like a lot of applications of economics, there's a danger in interpreting it and over emphasizing certain economics outcomes for these very distant futures. It's really hard to model the impacts of climate change in the economy. Historically a lot of economic assessments of climate damages have been dominated by agricultural impacts because they're one of the easier things to try to model through climate change. Sometimes, sea level rise impacts but we don't really have good estimates on like what are the cause of increased wildfires, what are the costs of increased tropical cyclone intensities and rainfall, what are the cost of tree mortality from like prime bark beetles spreading or disease vectors increasing or any of the myriad of other impacts of climate change, both known and potentially unknown as we rapidly end up in a future world.

Zeke Hausfather (31:03): There's also these very thorny issues you get into when you're looking at climate impacts in the economics literature around discounting. There is certainly a justification in economics to discount future earnings versus current earnings and discount future damages versus current damages with the assumption the world is going to be richer in the future and those will be relatively smaller in terms of their welfare impacts but it gets tricky when you start talking about intergenerational problems like this. There have been some big thinkers, Kenneth Arrow comes to mind, and a few other folks have really written compellingly on this question of intergenerational discounting and equity and how to best treat that. Oftentimes, the discount rate, more than any other factor in these sorts of economic models of climate change really dominates the solution space, in terms of does your optimal outcome become two degrees warming or 3.6 degrees warming or whatever and so I think it can be a useful exercise but I think we should take it with a veritable boulder of salt particularly when we look at very long-time horizons.

Zeke Hausfather (32:03): The other thing that has been useful coming out of the economics literature is the interesting interactions of socioeconomics and climate damages. So, in the latest IPCC report, we introduced a new set of scenarios called the shared source economic pathways or the SSP’s and what's interesting about them is they look at five different sort of socio-economic and technological futures for the planet and within each of those different pathways, we look at what would the world look like under different mitigations. So, what if we do nothing about climate change all the way down to what if we try to limit warming to one and a half degrees. By doing that you can look at the impacts of a particular level of climate change across different sets of possible futures. So, if you're looking at a three-degree warming world, you look at a three-degree warming world in the context of a world where everyone is rich and equal. Where we have almost no poverty, where there's really very little difference between rich and poor countries by the end of the century, where everyone is very technologically advanced, there's a lot of adaptive capacity. A three-degree world still ranks havoc on natural systems. Humanity can mostly adapt to that, whereas if you look at a different pathway a world that has very high population growth, low economic growth there's very high inequality regional conflicts isolationism. That's a world where three degrees is much more damaging because there's huge amounts of the world that does not have access to adaptive capacity, that doesn't have access to the resources needed to build sea walls, to install air conditioning, to genetically engineer crops to be heat tolerant, to keep people indoors and out of the sun on extreme heat events. So, I think the economic literature does help us in terms of those interactions because they are very important and we can't really ignore them but at the same time it does a disservice when we interpret it too literally, given the huge uncertainties and what the damages of climate change will ultimately be and how societies will respond to them.

Ben Yeoh (33:56): That makes a lot of sense although I do know a couple of economists who basically, say if you don't really discount future generations, you treat future generations how you'd want to treat yourself, like you treat your children grandchildren and great friend, how yourself then that slightly answers the solution because you get to this same answer which is actually you want to do an awful lot because you want to give future generations essentially what you want to give yourselves.

Zeke Hausfather (34:23): I didn't mean to paint all the plain economists with the [same brush]

Ben Yeoh (34:26): Well, it's complicated like you say.

Zeke Hausfather (34:27): Like Fran Moore and Gary Wagoner and a number of those other folks are doing really good work around these tough issues.

Ben Yeoh (34:35): Like say long term discounting, you get a certain set of answers from it which is what the models and things say but it's very hard like discounting up to 2100 right? You learn a lot of things which we are definitely going to be wrong about. Maybe, that's a good segue into cop 26 and perhaps my question here would be is what did you take away from it which was kind of positive or and what did you take away which was maybe a little bit disappointing? I was kind of intrigued by some of the analysis there's been a couple of kind of snap analysis one by IEA another by climate resources and things saying well if we meet all of these commitments and things we could be looking at a sub two degree world like 1.8, 1.9 and then you had a lot of critics saying well a lot of those commitments just don't seem to be really realistic so that probably means we're not going to hit and we're not going to hit sub two and then counter to that would be kind of what you've suggested is but direction of travel is really good and 10 years ago we wouldn't have thought that we were there. So, that's perhaps a segue into why you may or may not think 1.5 is achievable, actually sub 2 might be plausible but may be seen through the lens of any positive things coming out of cop 26 and any things you thought were a bit more disappointing.

Zeke Hausfather (35:52) Yeah, I should mention that I was in Glasgow and I actually put together an analysis with Piers Forster at the University of Leeds where we looked at all of these different projections that were coming out from climate action track or the IA, climate resources, the United Nations Environmental program et cetera during COP26. Instead of comparing and contrasting them and discussing these sorts of different scenarios, I’m happy to tie to link to that but ultimately, I think cop26 moved the needle in the right direction in an important way even if it wasn't a breakthrough moment in the way that say Paris wants but I also think people had somewhat unrealistic expectations going into it. The cop process was never set up to be, the world sits around it does nothing and suddenly we all get together and announce some giant breakthrough.

Zeke Hausfather (36:42): The way the system is set up is that countries update their commitments in the lead up to cop 26 and then there might be some small new announcements during the cop itself but it's mostly sort of working through all these thorny issues around climate finance and adaptation funding. The way carbon markets are going to work and be managed, the way you deal with forest accounting and emissions reporting and all these other sorts of gnarly details, some of which are quite important around the implementation of the Paris framework. And so, we did see some meaningful new commitments a cop. The global methane pledge definitely moved the needle more than most things. There’s an important pledge by Vietnam and South Korea and other countries to accelerate their coal phase out schedules. There was a compact and deforestation, and there were some announcements around electric vehicles that were important. There are some updates to NBDC’s (Nationally Determined Contributions) the sort of promises countries makes under the Paris agreement to reduce their emissions.

Zeke Hausfather (37:48) In particular we saw some new net zero commitments that were quite impressive from India, that if implemented, can move the needle and so sort of where we are coming out of cop is that going into the conference, the world was on track for about 2.6 or 2.7 C warming best estimate, plus or minus one degree c based on climate system uncertainties. Under policies in place today and under sort of 20, 30 commitments under the Paris agreement, we're on track for probably around 2.4 degrees warming globally, if all countries met their 2030 pledges and then maybe about two degrees warming if countries met their sort of longer term 2050, 2060 net zero commitments or net zero promises. Again, those latter categories should be heavily discounted. It's easy for leaders to say they're going to do something 30, 40, 50 years in the future when they're not going to be in power or in most cases even alive, it's a lot harder to actually deliver on that and the extent to which we should take those long-term promises seriously really depend on the extent where they're reflected in near-term commitments and there we definitely have seen a big gap between these sort of long-term promises countries have made and their near-term commitments but sort of coming out of cop26 we moved the needle in a few different ways.

Zeke Hausfather (39:00): In terms of these near-term commitments, so back in 2020, a year ago, the climate action tracker which is probably the best source for these projections said that 2030 commitments put us on track for about 2.60 warming by 2100. Going into cop26, updates over the past year as countries submitted new NDC’s brought that down to about 2.4 degrees if you add on top of that some small NDC updates at cop26, the new methane fledge, the coal phase out, the deforestation pledge that might shave another tenth of a degree C off 2100 outcomes, you're down to about 2.3 c and again every 10th of degree matters. Similarly, if you look at these long-term net zero pledges going into cop our best estimate was around 2 or 2.1 c outcome in 2100 with the new commitment by India and a few other countries, that's dropped down to about 1.8 degrees c if all of these net zero commitments are met. Which would be the first time we've really seen pledges by countries to do things on the ground that would result in less than two degrees warming globally and about a two and three chance of avoiding two degrees warming globally, which is significant.

Zeke Hausfather (40:15): There is some good news in that front but again it's this gap between long-term ambition and near-term commitments that's really worrying and countries like China, Like India in to an extent even rich countries like Japan, Australia, the U.S. need to do more in terms of near-term commitments to put us on track to get to these sort of net zero promises and I think that's going to be really the task in the lead up to cop 27 next year is firming up these short-term commitments and really bringing them in line with the emission reduction pathways needed to meet these long-term net zero promises. So that's the good news. The bad news is that I think coming into cop 26, the idea of limiting warming to 1.5 degrees on life support, nothing's impossible but I think it's becoming harder to imagine a world where we actually take action fast enough to limit warming to 1.5 degrees. At least in the absence of a very large amount of negative emissions later in this century or next century. So, if we want to limit global temperatures to 1.5 degrees with a reasonable chance of doing so, ends not overshooting it by much and even these scenarios have some overshoot they usually end up peaking temperatures at 1.60, we would have to reduce global emissions by about 45 percent in the next decade and no one is making commitments to that today.

Zeke Hausfather (41:47) Some rich countries like the US, the EU and the UK have committed to reduce their emissions by 50 percent but you can't expect countries like India or sub-Saharan Africa or Indonesia or even Brazil to make similar types of commitments given the rapidly growing economies given the need to lift hundreds of millions of people out of poverty. So, a world where you actually had a 45 reduction by 2030 involved much greater reductions in the rich world and bigger reductions in the developing world than we're seeing today and no one seems to be willing to commit to that right now and so in the absence of those sort of commitments it's just really hard to see a scenario where 1.5 stays alive. Now what you could have been a world where we do end up having some strengthening of commitments. We end up in a pathway for maybe 1.7c by the middle of the century and then the rich world promises in a big way to invest in carbon removal. So actively sucking carbon out of the atmosphere such that by the end of the century we're maybe removing half of what we emit today in addition to minimizing our emissions globally and getting that as close to zero as possible. In that sort of world, you could have an overshoot by a couple tenths of degree in the middle of the century and then ultimately end up around 1.5 by the end of the century and to be honest that's what a lot of the models in the IPCC for example that actually get to 1.5 degrees tend to do.

Zeke Hausfather (43:06): Of course, the challenge with that is you're talking about a sort of planetary scale engineering challenge later in the century with technology that's very needed today and so while it would be great if that ends up panning out then I think we should invest a lot more money and see if we can make that technology cheaper because it is going to have to be part of the solution. It's also very dangerous to bet on and to sort of give people false hope that we'll necessarily have a route to get there. So, in my view we're so close to 1.5 degrees, today we're at 1.2, today the remaining carbon budget is so small that at this point limiting warming to below 1.5 degrees without overshooting the target is pretty much dead and I think the extent to which we do have hope to ultimately get temperatures down to 1.5 degrees is going to end up depending a lot on carbon removal technologies and how fast we can get our emissions to zero to minimize the amount of overshoot we have.

Ben Yeoh (44:00): Sure, that makes a lot of sense. I guess then I’d be interested in your thoughts on what the degrowth movement would think. They came at it saying well we've got to do that and de-growth is the answer but it seems to me, particularly seeing through the pandemic and seeing that and seeing the fact that you've got to lift so many people out of poverty, I guess the kind of economic consensus is that d growth really doesn't work for that and then you end up maybe on the super optimistic end of a kind of I guess what would the d-growth people say. They'd say oh you just got tech bros where innovation saves the world and I guess you had a little bit of a pushback from d-growth with the sort of eco-modernist type of ideas and things coming up and like the tension between the two. Maybe you would have some comments on that from your position about to what elements d growth is just really unrealistic or are there any things we can take away from that and what elements are we too optimistic or not optimistic enough from what innovation and tech could maybe bring us.

Zeke Hausfather (45:08): Yeah. I mean on the question of degrowth what is ultimately limiting our ability to reduce emissions today is not the scenarios that climate scientists are putting together or energy modelers putting together. It's both the cost of clean energy technologies and the political willingness to take action rapidly to reduce emissions if it comes at a cost to society and I think the biggest problem with degrowth is it's hard to see how that moves the needle in that problem. It's not a popular thing. There's not a huge movement to support policies that shrink our economy and reduce jobs or otherwise. So much of what makes our politicians popular today is promises of growth and so it just strikes me as kind of a dead end, in terms of actually getting near-term action on climate change barring some sort of global consciousness shift around the issue that we're seeing very little signs of today.

Zeke Hausfather (46:10): I think there's a real challenge on political salience that has to be addressed. The other challenge of course is that most future emissions growth comes from countries that are poor today where economic growth is in fact essential to lift hundreds of billions of people out of poverty and so we actually have seen most rich countries starting to reduce their emissions over the past decade. I think 32 countries have now seen falling emissions despite rising GDP and in some cases like the UK they've fallen close to 50 percent already. So, I think we do have a pathway where we can reduce emissions in a way that isn't politically toxic, in a way that doesn't lead to hardship for people and in a way that can potentially create a path for countries that are poor today to follow in the footsteps. Countries like India are only going to make a net zero commitment or even a country like China for that matter. If they see a way to do so that does not put at risk their development trajectory and I think the fact that they are willing to make those commitments now is in many ways due to the fact that climate mitigation is seen as much cheaper today and much less damaging to the economy today than it was a decade ago, in large part, due to the progress we've made in reducing the cost of clean energy and I’m not going to defend excess consumption in rich countries per se, it's not the hill I choose to die on.

Zeke Hausfather (47:46): Certainly, if people want to create a movement for people to fly less, for people to drive smaller cars, for people to take voluntary measures to reduce their own environmental impact by eating less meat that's all-good stuff. I don't think we're going to have the political buy-in to actually ban hamburgers, for example, in rich countries anytime soon and so I’m much more optimistic about changing emissions in those sorts of sectors by creating viable alternatives for people. Personally I have switched from eating beef for the most part to eating impossible beef because I think it tastes just as good, might cost a dollar more per patty but it's an alternative that I can stick into the same dishes that doesn't involve a huge change and that has a tiny fraction of the climate impact of eating beef and so the more we can develop those sort of solutions that can sort of slot into our lives as they are today, I think the more seamless and rapid transition we'll see rather than asking people to fundamentally change their way of life and in some cases we may have to push bigger shifts in sectors where there are no other alternatives but I think so far we've had a pretty good track record of finding alternatives that have many of the same benefits of the uses of fossil fuels that people enjoy today.

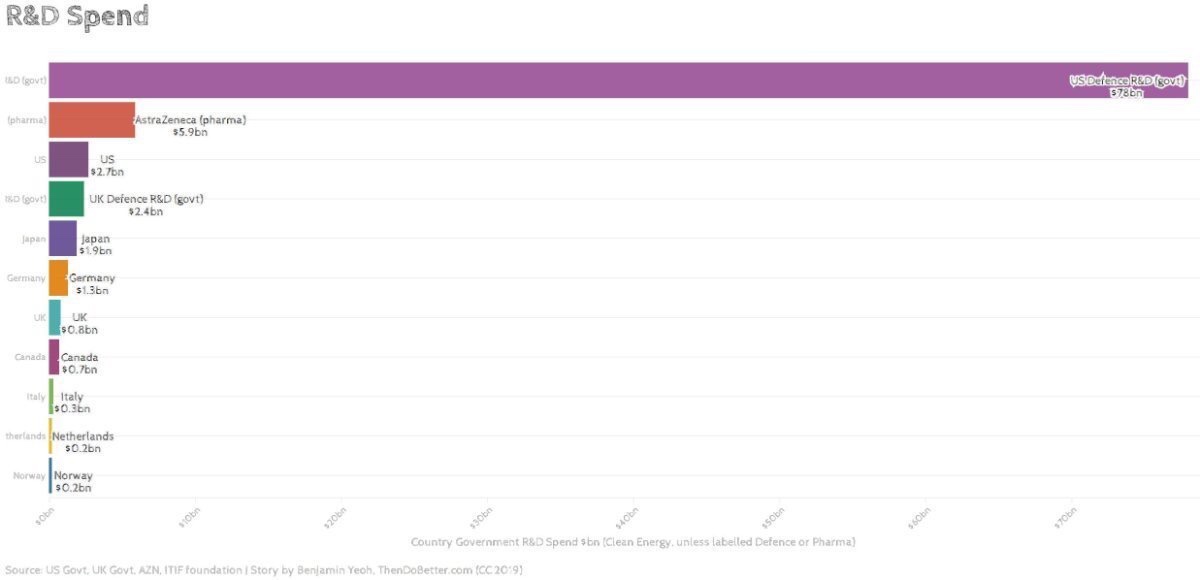

Zeke Hausfather (49:02): At the same time, I think there definitely is a risk of being sort of too techno-optimists. There is a column by Thomas Friedman, times yesterday that definitely fell into this trap it's like we need more Elon Musk and nuclear fusion is the future which is not to say that we don't need more innovators and throwing tons of money around into clean energy solutions and even long-term things like fusion is a bad idea. It's just that looking at those in isolation and seeing technology and sort of entrepreneurship in the free market is somehow divorced from the policy context is problematic and dangerous. A lot of or almost all of the technologies that are mature today that reduce our emissions from wind to solar to electric vehicles to nuclear fusion, which is potentially on the rise in the next two decades out of an enormous amount of government research policy support. And so, yes, we need to spend more money on innovative technology and the fact that the private sector is throwing a tsunami of money at this technology right now is a good thing. Just last week, Rivian, an electric automobile company went public here in the US. Despite having never sold a vehicle they now are more valuable than Ford Motor company in terms of their valuation.

Ben Yeoh (50:23): 180 billion market value.

Zeke Hausfather (50:24): Yeah, which is ridiculous uh but it’s certainly a sign that the market sees this as the future they're willing to throw huge amounts of money after it and it's going to accelerate your transition. But in the absence of policy, it's not going to happen fast enough and so I think if you're a techno optimist you can make the case for maybe 2.5-degree world or maybe even 2.3, 2.2-degree world is something that could come out. In a world where we had relatively limited policy but a huge amount of innovation and sort of optimism around technology but it's going to be very hard to go below two degrees without real government action to internalize externalities to subsidize the adoption of these technologies and to build a lot of the sort of support systems necessary for these technologies to scale. Renewable energy is actually a great example here. Wind and solar costs have fallen tremendously but they face real challenges to scaling up in the absence of large-scale public investments in transmission, for example and reform to environmental laws to more easily permit those and accelerate them. Investments in battery storage and other ancillary grid services so there is a need for more innovation and more private sector work in this and we are seeing a lot of positive science there but we also need a lot more government policy support to really get us the speed of the transition that we need to meet our client goals.

Ben Yeoh (51:45): Great! Okay, that makes a lot of sense to me. My son now eats impossible meat rather than normal burgers because he thinks it's pretty much the same and I guess Bill Gates has been going on and on about this although maybe he's a tiny bit techno-optimist as well. Maybe we'll have a quick-fire kind of overrated or underrated section or you could just do a quick comment because some of it is some kind of either or not. If you find it interesting, we can do it, so I’ll shoot out a phrase or an idea and you can go oh I think that's overrated because of X or underrated because of Y so we'll start with maybe one that you mentioned which is nuclear power but maybe particularly mini nukes. Do you think this is maybe overrated or underrated or any thoughts?

Zeke Hausfather (52:34): Depends a lot on who you talk to. Yeah, I’d say, probably overall a little underrated in part because one thing that's come out of the energy modeling world in the last few years is that there is a real need for what we call clean verb generation. So, renewables, variable renewables in particular can go a long way. At the end of the day, you're going to need 20 to 30 percent of your power to come from sources that can be available when needed, that are not subject to the whims of when the wind is blowing and when the sun is shining even in a world where you have a lot of transmission and storage and so nuclear is not the only option there. There's a huge amount of advances happening in geothermal, there's a lot of people very excited about green hydrogen as sort of a way of firming up variable renewables and doing seasonal storage though there's a lot of challenges there. But certainly, nuclear is one of the best technologies we have for that purpose today. So, I’d say it's a little underrated overall but the jury's still out in terms of if we can manage to build them on time and on a budget and see the same sort of learning curves, we've seen with renewable energy technologies.

Ben Yeoh (53:38): Sure, that seems very fair. Carbon offsetting.

Zeke Hausfather (53:45): It’d say it's overrated. There are a lot of companies today that are carbon neutral companies that have maybe reduced their actual emissions by 20 percent and then have bought a whole bunch of dirt-cheap forestry related offsets to call themselves carbon neutral to cover the other eighty percent and the problem is, if you take carbon out of the atmosphere and store it in the biosphere, it's not going to stay there forever. A lot of the wildfires we've seen in California this year were burning through corporate carbon offset projects and so, I think if companies were actually paying $600 a ton to do direct air capture and verifiably put that carbon into geologic storage, it would be a very different story but to the extent that carbon offsetting today is dominated by often to be honest, bullshit forestry offsets. I think it's a real problem and a lot of it is green washing and I think we need better differentiation in that market between permanent carbon removal, which is actually what's needed to counteract a ton of carbon that's emitted which is going to stay in the atmosphere for tens of thousands of years versus sort of temporary removal and to the extent that we are planting trees. We need very good systems to ensure that they stay in that location or that location remains forested for thousands of years to come to be equal to avoiding a ton of CO2 emitted which is a big challenge in a warming world which has much stronger stressors for the biosphere.

Ben Yeoh (55:10): Yeah. Even the higher quality nature-based solutions are less different between low quality offsets and high quality but even the high-quality ones are not necessarily set in stone. Like you say, if they're in the biosphere. That seems very fair.

Zeke Hausfather (55:23): So, we should actually try to set more of them in stone quite literally.

Ben Yeoh (55:28): Yeah, exactly. I guess this is a sort of an investment thing but I guess the movement is a divestment movement or maybe an engagement movement. What do you think about divestment strategies?

Zeke Hausfather (55:43): I have mixed feelings about them. I think they've been very successful in mobilizing people. I think they've certainly had a big effect on the economics of some projects in terms of the ability to get capital but I think we're also starting to see a little bit of a challenge right now in the strategies of targeting supply rather than demand. If you make it tough for people to get money to develop fossil fuel projects and you end up having production fall and prices rise, then there's huge amounts of political blowback and you end up with the US pressing for dramatic expansions of oil production despite going all in on climate and so I think it is useful and I think particularly when it comes to coal. It's quite useful because there's very little justification for investing anything in coal today but I think we need to make sure that all of these sorts of supply-side interventions are happening in conjunction with demand side reductions as well. Subsidizing electric vehicles so people are less sensitive to the cost of oil, subsidizing heat pumps so people are less affected by swings and natural gas prices and those sorts of things and I think there's a definite danger of political blowback if we focus too much on the supply side and not enough on the demand side.

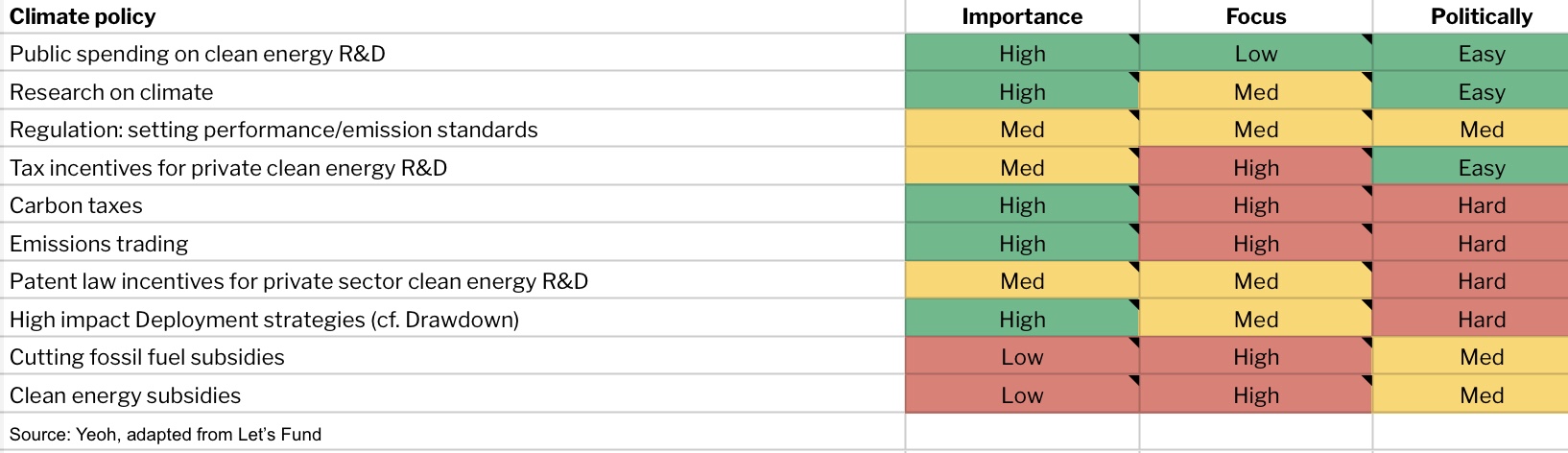

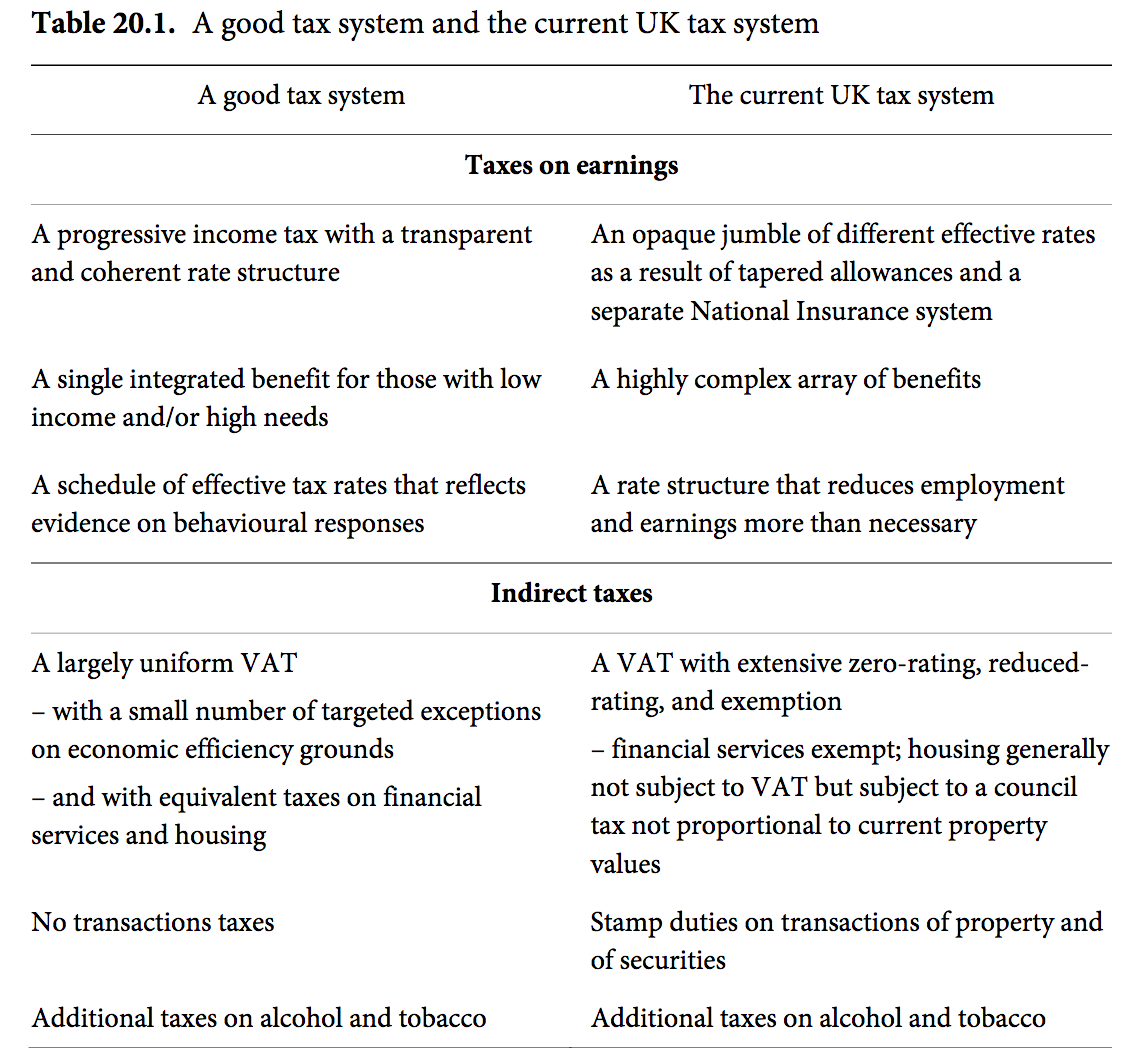

Ben Yeoh (57:02): Sure. Carbon tax or I guess carbon prices markets, that whole area of trying to price carbon

Zeke Hausfather (57:12): Overrated. I mean a carbon price is a necessary but not sufficient condition to keep decarbonization. By that, I mean, at the end of the day there are some things that you're probably going to want a carbon price to do but at the same time we have swings in terms of fossil fuel costs that are much bigger than any price on carbon that we're talking about imposing frequently in terms of gasoline prices or petrol prices and it has a relatively small effect on people's actual behavior and so I think that carbon prices have been a little oversold in terms of their, at least near-term effectiveness certainly if we're focusing on meeting targets. They don't have any sort of guarantees of actual efficacy in terms of reductions but also, there's just particularly here in the US, not much political salience for carbon pricing. Even progressive Washington state which tried to get a tax dividend revenue neutral carbon tax, failed miserably on a popular referendum and there's no appetite at all to pass carbon taxes today either from the left or the right in the US in politics and so it would be nice and I understand why economists love it and as a someone who's dabbled in economics over the years; I did my uh master's thesis at Yale a decade ago on sort of making tradable permit systems more tax-like but at the end of the day we need to go with what can actually be done and so yes to an extent, we can do a carbon price good but we shouldn't rely on it as our primary mechanism to reduce emission.

Ben Yeoh (58:46): Sure, that makes a lot of sense. Gas as a transition fuel or gas place within our energy systems.

Zeke Hausfather (58:55): A decade ago, it was not overrated. Today it's overrated in part because we have, at least, in the rich world transitioned away from coal in a large way. US coal use is down 60 percent in the last 12 years, UK coal use is pretty much zero now. Europe, some countries are doing a little worse in that transition but even there we're quickly running into a case where gas is becoming the sort of the worst marginal emitter as coal is phased out of many areas and so yes, we reduced emissions by replacing a lot of coal plants with gas but today increasingly renewable energy is cost competitive. There's much less of a justification today to the new gas infrastructure given the alternatives available. In particular, in many places like the US we already have too much gas infrastructure today which will play a role in helping balance out renewable generation, in the near term, until we get other sort of clean energy, clean form technologies available and more battery storage and transmission and all these other things but today I just think there's much less of a role for gas replacing coal than there was a decade ago. We've already replaced most of what we can, economically, there.

Ben Yeoh (01:00:11): Yeah, that also makes a lot of sense and it’s the fact that things have changed and changed quite quickly within a decade.

Zeke Hausfather (01:00:19): It's also worth pointing out that with methane leakage, gas is better than coal but not as brilliant as we thought.

Ben Yeoh (01:00:27): The data we have on it is not so good so it could well be underestimated from what we've seen and stuff, I guess that's an issue as well. The idea of a green new deal, does a lot of these innovations and things really come with new jobs or is that kind of a separate issue so green new deal.

Zeke Hausfather (01:00:52): So, I think in the US context, the green new deal was an interesting political exercise. I think there is a certain amount of danger to sort of attaching a wide range of other unrelated social policies to climate measures like a guaranteed jobs program or universal health care, all these other things which are good in their own right but to the extent that we want climate policy to be something that can be durable. Ultimately it can't just be a big left issue. A permanent leftist majority is not a replacement for effective climate policy and countries that have done the best to reduce emissions like the UK are countries where climate is not so much a polarized issue, at least acceptance of the basic science is certainly not. And so, I think there's definitely some challenges there on the jobs front there are a lot of jobs in installing clean energy, there's a lot less jobs in maintaining clean energy than there are fossil fuels and I think that distinction is important and certainly there are a lot of regions where many of the jobs today are tied up in fossil fuel production where you're not going to be able to see a one-to-one replacement particularly in terms of geographic concentration of future clean energy jobs. So, I think as we're moving toward a world of more clean energy and less fossil fuels, we do need to always keep in mind sort of the need for a just transition and to help those who will be most impacted by these changes and not just sort of say “well we're going to create more jobs by installing solar panels so we don't have to worry about it right it's a much more complicated issue than that”

Ben Yeoh (01:02:30): Excellent, that makes a lot of sense to me as well. Perhaps coming through to the last couple of questions then. I was wondering if you had any view on the Bjorn Lomborg position, we’re concentrating on the wrong things that actually if we invested in all of these other areas you would get a much better deal for all of this and that the over emphasis on some of this climate thing. It’s a kind of like a misallocation of resources and maybe I would extend the sort of the commentary if you would to the fact that this just still seems to be maybe unhelpfully for an outsider looking in, quite a lot of heated debates. I guess you get this in a lot of sciences in general but you get people and they're kind of commentating against one another and it doesn't seem like that they're very aligned which I guess causes some confusion and I can see this in when I speak to some of my friends but be interested generally on the Lomborg position and then whether the consensus around where science can be. You can never get to a position where you're not going to get these kinds of heated debates or seemingly striping at one another.

Zeke Hausfather (01:03:43): Yeah. I mean on the Lomborg position, I think fundamentally his mistake is assuming that everything is zero-sum. When it comes to climate mitigation and poverty alleviation and all these other pressing issues that the world faces, we can sort of walk and chew gum at the same time so to speak. Certainly, if your criticism was misallocation of resources, you could make a much stronger claim around say military spending than climate mitigation spending in terms of reallocation to humanitarian measures of poverty alleviated. I think we're increasingly realizing that climate impacts and climate mitigation are tied into development in a way where you can have mutually beneficial outcomes particularly if rich countries can get their act together and actually help subsidize the adoption of clean energy technologies by poor countries in a big way and that's been a huge area of battle in the international. It's one of the biggest flash points, in Glasgow, is sort of around this question of what extent should rich countries be paying poor countries to help both adapt to climate change but also to mitigate climate change and I think poor countries have a very strong argument there. They're like look you rich countries destroyed the environment in your development process and now you want to slam the door behind you and I think that balancing that out and ensuring that poor countries have a way to meet their development goals robustly while transitioning to clean energy is critically important but again going back to the point I made earlier, I think that that's become much less of a trade-off now than it was a decade ago and I think the fact that we are starting to see all these big net zero commitments and even some more near-term commitments by poor countries is really an acknowledgement that there is not necessarily a large net cash cost or even in some cases a net cost to transitioning away from fossil fuels.

Zeke Hausfather (01:05:32): Obviously, it depends how rapidly you do it. If you ask India to get its emissions to zero in 20 years that would impose a huge cost and have a big conflict with development priorities but I think we now see a pathway to at least a below two-degree world where countries are not really bearing much of a cost in the transition. In part, because we've seen such dramatic cost declines in fossil fuel alternatives. So, I don't think there is nearly as much of a trade-off as folks like Bjorn would emphasize. Lomborg also is just to be honest a bit of a consummate cherry picker on these issues, my favorite example of his work is, he did a paper looking at the impact of the Paris agreement which I think we'd all recognize now along with these longer-term technology trends this had a big impact in changing our future warming trajectories. Back then he argued that well countries will just meet their 2030 pledges and then in 2031 they'll go back up to rcp 3.5 emission pathways and therefore Paris will only cut global temperatures by like not .2c or something. Yes, and in that very tortured construction it would, but it's sort of ignoring everything else that's going on and so I think you often need to take some of Yorn's work with a grain of salt and those sorts of things because he does have a bit of an extra grind in these issues. He’s not always wrong but he's often cherry-picking.

Ben Yeoh (01:06:53): Yeah, he makes his point and then finds the model to back it up.

Zeke Hausfather (01:06:58): Yeah, in terms of sort of scientist consensus on climate, there's not much fundamental disagreement in the scientific community around the basics here. The earth is warming, co2 is a greenhouse gas, we're responsible for c2 emissions. Therefore, we're responsible for most of the warming the world has experienced. Where there are big scientific disagreements is what is climate sensitivity exactly, how much is the earth going to warm in the future, what are these various tipping elements or feedbacks? There's a lot of different views there and I think the way that science happens in academic journals and at conferences is fairly divorced from the way it gets presented in the media. It's gotten a little bit better but you still see a lot of both sides’ presentations in the media in a way that isn't really reflective of the scientific literature or the scientific community. Certainly, not the way I’ve experienced at conferences and we actually have some pretty good mechanisms for reaching consensus and communicating that consensus through the IPCC process and if you ever read IPCC reports. They are very cautious; in fact, some people criticize them for being too cautious on emphasizing what we know and where the remaining uncertainties are and I think that that process has really been helpful for the community to sort of synthesize their knowledge to talk across the many different disciplines to make up climate science and get a much more unified voice from the scientific community on this issue.

Zeke Hausfather (01:08:19): Then to be honest, you even see in other scientific fields like medical science could really use an IPCC for example, as we've seen with all of the fights over masking and vaccination and everything else involved with Covid. I feel like in some ways climate scientists are a bit ahead of the game.

Ben Yeoh (01:08:36): Yeah, I know. Like extending that into economics and readings on macroeconomics they can't agree on inflation or interest rates. You would have thought some of their very basic building blocks are massive disagreements still going on there. Great and so maybe then the last question would be what advice do you have for people who want to be involved in climate?

Zeke Hausfather (01:09:14): I mean build a useful skill that fits into a good niche. Be that data analytics, be that communication and writing, be that climate modeling or economic modeling and find an organization that's aligned with your interest on that. One of the challenges with working in the climate world is you’re not going to make as much money as if you work for google right. The fact that so many people want to make a positive impact on the future, means that organizations particularly environmental and nonprofits tend to have relatively low salaries in part because they have a flood of interested and highly qualified people wanting to do that work. So, unless you're working for a hot cleantech startup, you're probably not going to make a huge amount of money out of doing climate work but nevertheless, you're going to have a much bigger impact than you would if you were optimizing the advertising algorithm for some web-based company. So, there are trade-offs there when you're thinking about careers but I think at the end of the day the quality of life you have knowing that your work is making a difference in the world is much more valuable than maximizing your 401k. So, I’d say find a niche. Find an organization aligned with your values and see the biggest impact you can make there.

Ben Yeoh (01:10:32): Great! Well, that strikes me as being excellent advice. So, with that, Zeke, I would like to say thank you very much

Zeke Hausfather (01:10:41): Thank you. It's great to be on.

UK government behavioural insights team secret report on NetZero

This fascinating "secret report"* from the UK government behavioural insights team on #NetZero "principles for successful behaviour change initiatives". "When we view ‘behaviour change’ narrowly as an exercise in asking citizens to make different choices, the scale of change required to reach Net Zero is daunting, and an enormous political challenge. Moreover, the evidence from past case studies and decades of behavioural science research shows that awareness-raising and calls to action will not get us there. Though everyone has a degree of agency in changing their behaviour, and well-crafted messages from government can certainly be influential, behaviour is simply too profoundly driven by factors in the environment rather than in hearts and minds. As it stands, low-carbon behaviours are often more costly, less convenient, less available, less enjoyable, and rarely the default choice.

But this is ultimately an opportunity, because the more politically feasible approach is also the far more effective approach – to move further upstream and change these contextual factors. By focusing less on individual behaviour, towards bold policy targeting choice environments, institutions, businesses, and markets, it becomes an exercise in ‘world building’ more than ‘behaviour change’ per se. ...

...There are various degrees to which public engagement will be necessary, from more passive to more active (acceptance of policy or infrastructural changes; willing adoption of new technologies; or direct individual action). Building a compelling and positive narrative, with clear asks, can help to do this effectively, despite communications on their own tending to have a very modest impact on behaviour change. ...

...we do not have all the answers and evidence on ‘what works’ is continuing to grow. It will be more critical than ever to maintain an agenda of evidence-generating policy, as well as evidence-based policy: testing as we go and trialling new approaches. Behavioural science is far from exhausted, with many original ideas waiting to explored. ...

If we can impart one lesson, the first law of behaviour change would be this: reduce the burden of action for the greatest number.

*This is a public domain license, but note: ... A government spokesperson said: “This was an academic research paper, not government policy. We have no plans whatsoever to dictate consumer behaviour in this way. For that reason, our net zero strategy published yesterday contained no such plans.”

And therefore the report is no longer available on the government website making the report a sort of "secret". Story here:https://www.theguardian.com/environment/2021/oct/20/meat-tax-and-frequent-flyer-levy-advice-dropped-from-uk-net-zero-strategy

EU netzero, Adam Tooze take

Source:Mckinsey via Adam Tooze