Analysis on oil, renewables, mobility and EVs.

-Oil has a massive flow-rate advantage, but this is time limited.

-Economic and environmental benefits set to make renewables in tandem with EVs irresistible. T

-The death toll for petrol.

Mark Lewis, former utilities analyst and ex-Carbon Tracker now, head of sustainability for BNP AM writes an analysis on oil, renewable energy and EVs.

“Oil needs long-term break-evens of $10-$20/bbl to remain competitive in mobility.

In this report we introduce the concept of the Energy Return on Capital Invested (EROCI), focusing on the energy return on a $100bn outlay on oil and renewables where the energy is being used specifically to power cars and other light-duty vehicles (LDVs). For a given capital outlay on oil and renewables, how much useful energy at the wheels do we get? Our analysis indicates that for the same capital outlay today, new wind and solar-energy projects in tandem with battery electric vehicles (EVs)* will produce 6x-7x more useful energy at the wheels than will oil at $60/bbl for gasoline-powered LDVs, and 3x-4x more than will oil at $60/bbl for LDVs running on diesel. Accordingly, we calculate that the long-term break-even oil price for gasoline to remain competitive as a source of mobility is $9-$10/bbl, and for diesel $17-19/ bbl.

Oil has a massive flow-rate advantage, but this is time limited.

The oil industry is so massive that the amounts that can be purchased on the spot market can provide very large and effectively instantaneous flows of energy. By contrast, new wind and solar projects deliver their energy over a 25-year operating life. Nonetheless, we think the economics of renewables are impossible for oil to compete with when looked at over the cycle. We calculate that to get the same amount of mobility from gasoline as from new renewables in tandem with EVs over the next 25 years would cost 6.2x-7x more. Indeed, even if we add in the cost of building new network infrastructure to cope with all the new wind and/or solar capacity implied by replacing gasoline with renewables and EVs, the economics of renewables still crush those of oil. Extrapolating total expenditure on gasoline in 2018 for the next 25 years would see $25trn spent on mobility, whereas we estimate the cost of new renewables projects complete with the enhanced network infrastructure required to match the 2018 level of mobility provided by gasoline every year for the next 25 years at only $4.6-$5.2trn.

Economic and environmental benefits set to make renewables in tandem with EVs irresistible. The clear conclusion of our analysis is that if we were building out the global energy system from scratch today, economics alone would dictate that at a minimum the road-transportation infrastructure would be built up around EVs powered by wind- and solar-generated electricity. And that is before we factor in the other advantages of renewables and EVs over oil as a road-transportation fuel, namely the climatechange and clean-air benefits, the public-health benefits that flow from this, the fact that electricity is much easier to transport than oil, and the fact that the price of electricity generated from wind and solar is low and stable over the long term whereas the price of oil is notoriously volatile.

The death toll for petrol. With 36% of demand for crude oil today accounted for by LDVs and other vehicle categories susceptible to electrification, and a further 5% by power generation, the oil industry has never before in its history faced the kind of threat that renewable electricity in tandem with EVs poses to its business model: a competing energy source that (i) has a short-run marginal cost (SRMC) of zero, (ii) is much cleaner environmentally, (iii) is much easier to transport, and (iv) could readily replace up to 40% of global oil demand if it had the necessary scale. We conclude that the economics of oil for gasoline and diesel vehicles versus wind- and solar-powered EVs are now in relentless and irreversible decline, with far-reaching implications for both policymakers and the oil majors.”

My sustainability performance show: Thinking Bigly.

My travel essay about visiting one of the most remote tribes on Earth in the Indonesian Jungle.

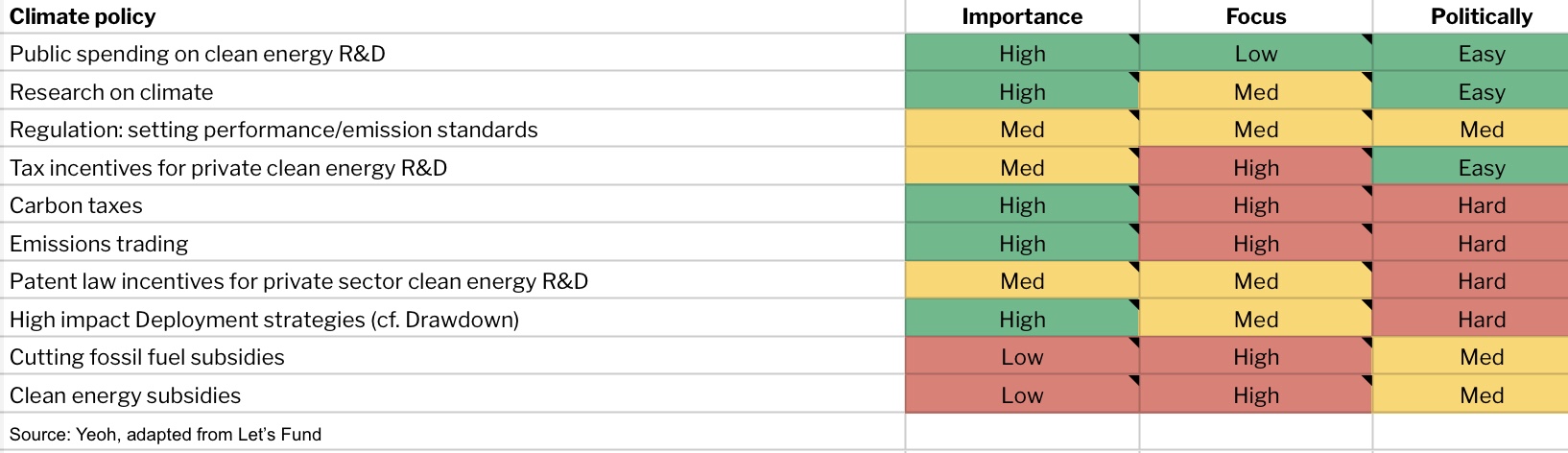

The Climate challenge is 75% outside power: https://www.thendobetter.com/investing/2019/7/12/climate-challenge-outside-power