Grantham and colleagues have looked at the S&P500, over the last 28 years, 60 years, and 90 years; excluding a major sub-component sector each time. Grantham’s overall conclusion it that it didn’t make much difference in return - although some might argue at the max range of 50bps that compounded over 28 years may be significant. Others might suggest that the power of diversifcation and time, also makes this conclusion unsurprising.

Caveats could include: not peer reviewed (although I have found similar conclusions with slightly different data sets), different exclusions may produce different answers (specifically Tobacco might come up as a narrow exclusion; cf Dimson’s data set on “sin stocks”), and that S&P500 is not world representative (however it has the best long run data set, and is a widely used index that does represent a facet of corporate America).

Grantham writes (see link to LSE talk here)

“So my colleagues and I finally carried out a test to see exactly how an investment portfolio would have been affected by divesting from a group of companies that are listed in the Standard and Poor’s 500, the index based on the market capitalisations of 500 large companies listed on the New York Stock Exchange or NASDAQ.

These companies can be divided into 11 sectors (not including real estate). We considered the 10 long-term sectors (real estate was added relatively recently), and analysed how the index performed without each sector.

Initially, we considered the period from 1989 until 2017. [The results are shown in Figure above]. You will see how dramatically the index changes with the removal of each sector – there is only a 50 basis points difference between the best and the worst. They are basically all the same!

You will see that excluding the information technology sector made a small difference for a few years around the turn of the millennium. That was the technology bubble. Beyond the burst of the bubble, all of the indices track together again, as if nothing had ever happened.

But basically, all of those 10 variations of the index track between 1989 and 2017 as if they were the same. So we decided to see what happened if we chose a different period, incase there was something extraordinary about the past 28 years. We extended the analysis, first to start from 1957, and secondly to begin in 1925.

Source: same as chart above

You will see in chart above that changing the period of analysis does not make much difference. The difference between the best and worst is 54 basis points instead of 50. So over 90 years, it would not have cost an investor to have divested from any one of the sectors.”

Grantham further writes:

“Who knew that the stock market was that efficient? It may be hopeless in bubbles and busts, but it has evidently priced these groups of big companies pretty well. And there is no advantage to an investor of choosing the high-growth information technology sector over, say, utilities. Utilities are priced down and information technology is priced up, but they produce the same returns. It is amazing.

What does this mean for divestment? It means that if investors take out fossil fuel companies from their portfolios, their starting assumption should not be that you have destroyed the value. Their starting assumption should be until proven otherwise. that it will have very little effect and is just as likely to be positive by 17 basis points as negative. That is an amazing contradiction to what every investment committee has ever said, as far as I am concerned.

It obviously takes a major miscalculation to move the dial when it comes to divestment. I think that decarbonisation is just such an event. And the reason I think that is that the oil companies and the chemical companies are not rolling with the punches. They are fighting decarbonisation tooth and nail. They are still funding obfuscation programmes in North America. And if you do that as a corporation, as a capitalist, you are likely to bite the dust if you are facing a major change, if you fight it. And they are fighting it. If they rolled with the punches, they might do quite well, and bleed off their capital and pay big dividends. But they are not doing that.”

I’d like to add a thought or two on the theoretical framework here. There are two to note one is

The Active Law of Fund Management which suggests the bigger the investment universe the better the risk/return potential, and,

The Efficient Market Hypothesis which suggests information is priced in efficiently such that it is hard to outperform large diversified markets

Both are theoretical although backed up by certain lines of empirical evidence (I’ve been drafting a long blog on the EMH for a while, hopefully out one day), although both are not considered perfect to explain what we can observe empirically.

As Grantham alludes to, this suggests the power of reasonable large scale diversification, and time. It seems to suggest over long periods of time, no one sector has such strong outperformance that it significantly dwarfs a large fairly diverse group of companies/stocks. I’m guessing there are always 400 to 450 stock left in any one excluded portfolio.

It’s an interesting challenge to certain notions of thematic and smart beta ideas as well, although those assessed differently.

Many of us are in the forward looking future prediction game. Although again, this might suggest, as Warren Buffet and Jack Bogle do that the average investor is then best off in low cost trackers (although note possible limited stewardship??!!), and if they wish to lose a sector or two it’s not likely to be a big impact (perhaps a small plus or minus in the order of 25 to 50bps; and arguably hard to predict although as Grantham argues, it might be oil, chemicals but for business related reasons).

I actually see Grantham’s work replicated in shorter run indices. You can look them up put the ex-Tobacco or ex-fossil-fuel type indices over the last 5 to 10 years have all done better or in the same ball park than the standard index. 5 years is short run, but might suggest that something has happened in the last 5 years perhaps different to eras further back.

In any case, back to oil divestment, so you need to know Grantham has a long time view (bias) here and sponsors the Grantham institute. Might mean he is right and has spent a long time thinking about this. He’s being doing investment (albeit more macro and asset class lens) for much longer than me.

Still, this is a decent evidence base and theoretical framework for arguing for the divest – stranded asset argument. It also highlights the area for engagement, if it can help bend these companies at all.

This all comes from a talk given in April 2018 at the LSE.

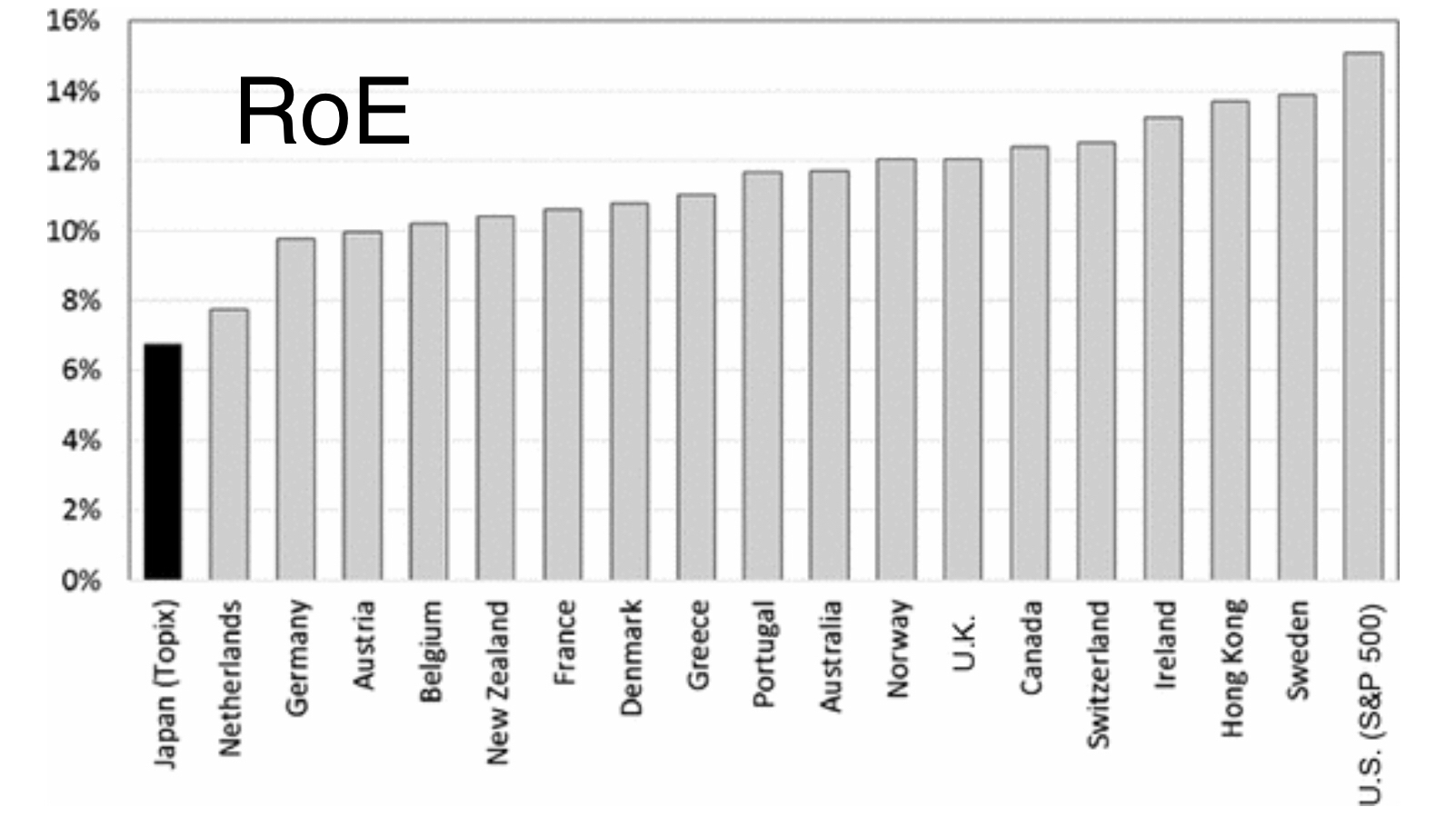

Source: LSE lecture (link here), although Grantham is quoting HSBC work

In the lecture, Grantham is mainly focused on climate, weather and food. Slides here, talk below.

On climate - click here for more carbon related posts. There's an argument made by risk philospher and Black Swan author Nassim Taleb on why we should lower pollution regardless of models.

The current Arts blog, cross-over, the current Investing blog. Cross fertilise, some thoughts on autism. Discover what the last arts/business mingle was all about (sign up for invites to the next event in the list below).

My Op-Ed in the Financial Times (My Financial Times opinion article) about asking long-term questions surrounding sustainability and ESG.

Some popular posts: the commencement address; by Nassim Taleb (Black Swan author, risk management philosopher), Neil Gaiman on making wonderful, fabulous, brilliant mistakes; JK Rowling on the benefits of failure. Charlie Munger on always inverting; Sheryl Sandberg on grief, resilience and gratitude.

How to live a life, well lived. Thoughts from a dying man. On play and playing games.

A provoking read on how to raise a feminist child.