Bloomberg article suggesting ESG is mainstreaming “going global in 2017”. For various reasons, I don’t think I fully agree, but it is a nuanced argument, too long for a short blog.

Still interesting to note.

Your Custom Text Here

Bloomberg article suggesting ESG is mainstreaming “going global in 2017”. For various reasons, I don’t think I fully agree, but it is a nuanced argument, too long for a short blog.

Still interesting to note.

High return on investment presents. Last minute Christmas gifts. Economists argue that buying presents is a value loss as recipients do not value the gifts at the same value as bought.

These economists suggest cash is the best gift as economic value is not destroyed. Tim Harford in the FT (Link here, behind paywall) in 2016 looked at Joel Waldfogel’s notorious research paper, The Deadweight Loss of Christmas, Waldfogel showed that gifts typically destroy value, in the sense that the giver had to pay more to buy the gift than the recipient would ever have been willing to spend on it.

Richard Thaler Might disagree (post here) arguing rational “hominem economist” is fantasy. Cash gifts are frowned open.

I have several gift ideas which have a high RoI. These gifts utilise the equation:

Time + Unique + You = Priceless a gift of time and attention and thought.

Poetry/Writing: Write them a poem. Write them out your favourite poem. Record a video or audio of you reading a poem (or short story) to your loved one.

Even for the young child who has everything, they won't have a video of you reading their favourite book.

Write a letter about a time together or why they are important to you.

Recipes: Collect recipes from friends and write them in a book. A short story about their importance is a welcome touch.

If you take the time to create/make/cook some thing, this has “positive value” both economically and socially. There are many items in the read/eat/drink category that most people enjoy.

Cook some thing, make a cake; confit a duck leg (recipe here, keeps for 6 months); order some green coffee beans, roast them yourself for a coffee lover, present them with roasted beans (worth over 10x the green bean value plus 30 minutes or so roasting time, I’ve done it in a pan similar to this). You can brew your own gin, ginger ale, make lemonade.

You can make simple jewelry, with a little more time you could learn to knit or something to actually make a garment, though I appreciate that is probably above what can be easily achieved.

You can make them a mix tape / CD / on line mix -- with personal commentary. The mix tape was a teenage rite of love in decades past.

Busy parents might appreciate a "voucher" for baby sitting time offered by the gifter. We value experiences more than objects when it comes to happiness.

One final note, for those who mostly have what they want. A charitable donation to the receivers’ favourite charities - most countries, you gain some tax back, could also be a positive return.

If you'd like to feel inspired by commencement addresses and life lessons try: Neil Gaiman on making wonderful, fabulous, brilliant mistakes; or Nassim Taleb's commencement address; or JK Rowling on the benefits of failure. Or Charlie Munger on always inverting. Or Ray Dalio on Principles.

Read about my questions to a dying man, on how to live a life well lived.

Or, a thought about the narrative of Bitcoin.

A look at a paper exploring face-to-face communication.

"Has technology made face-to-face communication redundant? We investigate using a natural experiment in an organisation where a worker must communicate complex electronic information to a colleague. Productivity is higher when the teammates are (exogenously) in the same room and, inside the room, when their desks are closer together. We establish face-to-face communication as the main mechanism, and rule out alternative channels such as higher effort by co-located workers. The effect is stronger for urgent and complex tasks, for homogeneous workers, and for high pressure conditions. We highlight the opportunity costs of face-to-face communication and their dependence on organisational slack."

Writes Diego Battiston, Jordi Blanes i Vidal, Tom Kirchmaier in their paper: Is Distance Dead? Face-to-Face Communication and Productivity in Teams link to paper here

“We exploit a natural experiment to provide evidence on the relation between distance, communication and productivity in a large public sector organisation: the branch in charge of answering 999 calls and allocating officers to incidents in the Greater Manchester Police. An incoming call is answered by a call handler, who describes the incident in the internal computer system. When the handler officially creates the incident, its details are available to the radio operator responsible for the neighbourhood where the incident occurred. The radio operator then allocates a police officer on the basis of incident characteristics and officer availability. The main measure of performance available to the organisation is the time that it takes for the operator to allocate an officer. Unfortunately, delays often result from the radio operator’s need to gather additional information. One way in which she can do this is by communicating with the call handler electronically or in person.”

“We find that allocation time is 2% faster when handler and operator work inthe same room. An important consequence of this faster response is that it decreases the likelihood that the operator misses the country-wide target for a maximum allocation time- a metric by which police forces are evaluated by the UK Home Office. We also show that proximity within the room is important - the effect of co-location is 4% when handler and operator are sitting very close together.”

“We provide two additional sets of results. Firstly, we establish that being able to communicate face-to-face has a higher effect for: (a) more urgent and information intensive incidents, (b) in conditions of higher operator workload, (c) when the teammates are more homogeneous (in terms of age and gender), and (d) when the teammates have worked together more often in the past. Secondly, we highlight and compute the opportunity costs of face-to-face communication.”

“This paper provides, we believe, the first detailed causal evidence on the relation between proximity, communication and productivity inside organisations. Of course,the study involves a particular setting and production technology. As such, the implications are stronger for high pressure environments such as the healthcare professionals assessing and treating patients in emergency rooms, or the frontline staff and their supervisors in air traffic control, the military, and other time-critical settings. More generally, we also believe that the insights on the contingent value of face-to-face communication have broader applicability.”

This paper looks at this from the point of view of worker productivity. But, it makes me wonder how many other social type interactions benefit from face-to-face interactions over electronic or social media.

Perhaps there is more to Nassim Taleb’s love of parties (though not artsy fartsy ones) than only the benefits of focused randomness.

If you'd like to feel inspired by commencement addresses and life lessons try: Ursula K Le Guin on literature as an operating manual for life; Neil Gaiman on making wonderful, fabulous, brilliant mistakes; or Nassim Taleb's commencement address; or JK Rowling on the benefits of failure. Or Charlie Munger on always inverting.

There's a discussion on what makes a life well lived, by a fun theorist.

Cross fertilise. On investing try a thought on stock valuations. Or Ray Dalio on populism and risk. You can also click on the Carbon tag below.

A lesson from autism here. And a post on the seductive story of Bitcoin

Self awareness is helpful. Self awareness without charge is unhelpful. Socrates wrote "Know Thyself" (noted from a temple)* and 2000+ years later a leadership-management-self-help industry has spawned.

Allison Vaillancourt writes in the Chronicle of Higher Education: "It is rare to have a conversation lately about workplace dynamics in academia that does not include discussions about the notion of emotional intelligence and the critical need for self-awareness among those who want to effectively lead or interact with others. Understanding our strengths, weaknesses, and blind spots is increasingly considered essential to good management."

She cites 3 lines of evidence:

(1) Insight, a new book by Tasha Eurich, an organizational psychologist. According to Eurich, 85 percent of us have a faulty understanding of how we appear to others or how we affect them.

(2) The Daniel Goleman work on Emotional Intelligence - you can see a short discussion here on his site.

(3) Erich C. Dierdorff and Robert S. Rubin ( DePaul University) , wrote about self-awareness in an essay for the Harvard Business Review. High levels of self-awareness, they argued, increase team performance, decision making, and conflict management. They noted, however, that most of us are remarkably clueless about how others perceive us

But, she writes

"I am noticing a surprising trend: I see more and more leaders who seem to be embracing negative feedback and almost bragging about their perceived deficits, while continuing to engage in the very behaviors that colleagues have asked them to stop or tone down."

She notes:

It is good to be self-aware. But demonstrating self-awareness, while at the same time showing a lack of discipline to fix issues of concern, is worse than being clueless about our shortcomings.

The most effective people I know sometimes whimper for a bit after receiving constructive criticism, but they quickly put a plan in place to modify the annoying or offending behaviors. By doing so, they demonstrate respect and appreciation for those brave enough to share difficult truths that are offered with the very best intentions. "

We need our colleagues to help us be better, but they can’t help if we’re not listening.

*The Ancient Greek aphorism "know thyself is one of the Delphic maxims and was inscribed in the pronaos (forecourt) of the Temple of Apollo at Delphi.

If you'd like to feel inspired by commencement addresses and life lessons try: Ursula K Le Guin on literature as an operating manual for life; Neil Gaiman on making wonderful, fabulous, brilliant mistakes; or Nassim Taleb's commencement address; or JK Rowling on the benefits of failure. Or Charlie Munger on always inverting.

Cross fertilise. On investing try a thought on stock valuations. Or Ray Dalio on populism and risk. You can also click on the Carbon tag below.

A lesson from autism here. And a post on the seductive story of Bitcoin

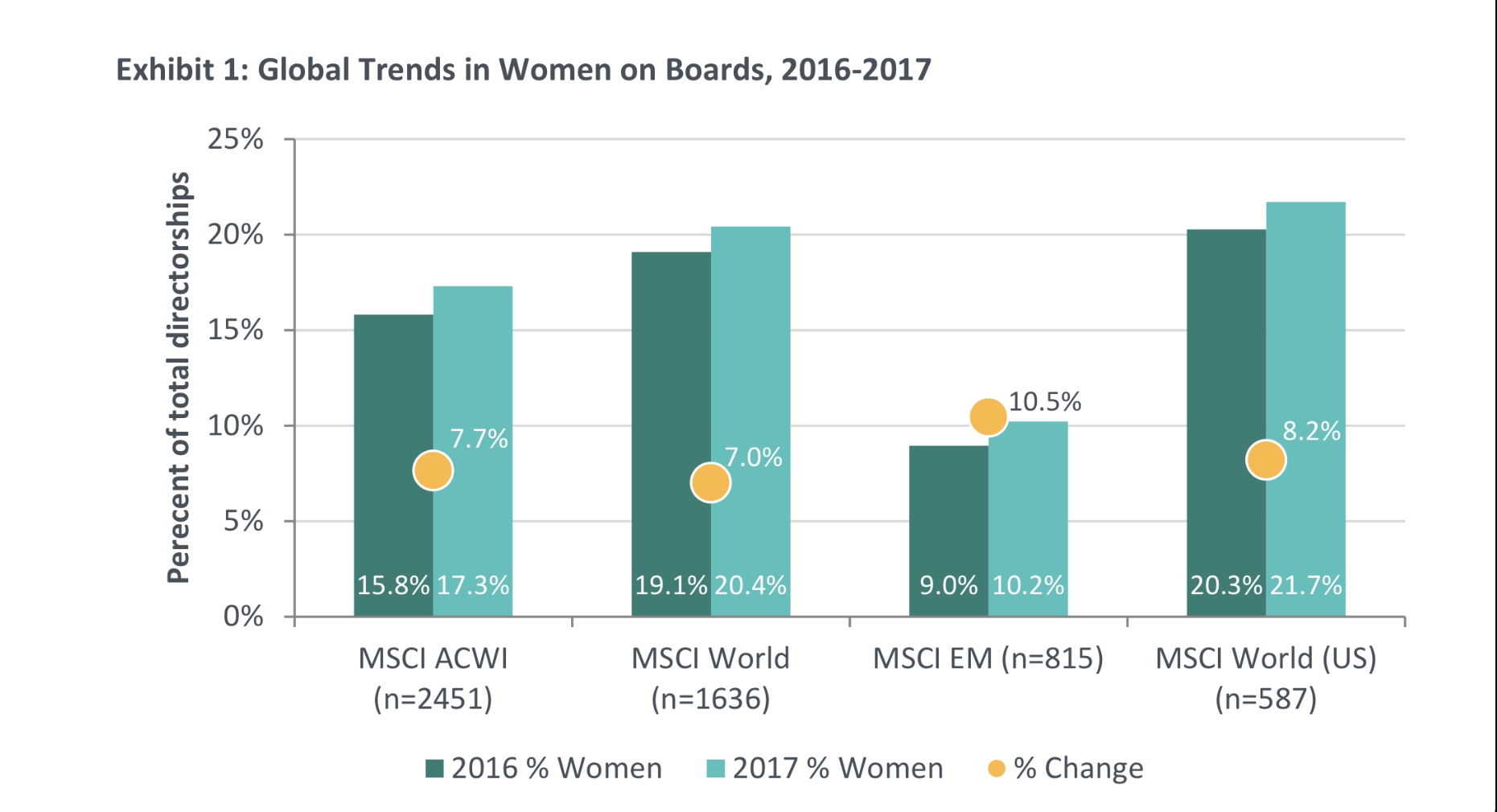

I found these numbers shocking. In the ACWI world index, only 17% women board directors. Only 28 out of 2,541 members of the MSCI ACWI Index (1.1%) had boards consisting of at least 50% women. Only 7 had boards majority female. (My data is from 2017, but this MSCI paper is 2015 data, which is all a little worse)

23% of ACWI have all male boards (as of Oct 2017). That's over 1 in 5 ACWI companies.

Sure, we must focus of equality of opportunity and not necessarily outcome. But, these indicators suggest we still have some way to go.

Is it a surprise we have MeToo when the makeup of people in power are so dominantly men?

Of course, there are other lens to seek diversity of thought and to reflect the fabric of our society. But we can be intersectional and multi-faceted, running ‘identities’ in parallel.

Mother, daughter, girlfriend, sister, partner – we can be all these at once. It is healthy for the boards of the companies of our world, not to better reflect the mix of our world?

A note on academic papers below here

In terms of eg company profits, Peer-reviewed academic data is mixed (despite what certain media and consultant reports might say) made harder as causality/correlation is difficult. There is a good non-technical summary by Katherine Klein (Wharton) here examining two meta-studies (Post and Byron, 2015, 140 studies of board gender diversity with a combined sample of more than 90,000 firms from more than 30 countries) and (Pletzer, Nikolova, Kedzior, and Voelpel (2015) in a different approach, conducting a meta-analysis of a smaller set of studies — 20 studies that were published in peer-reviewed academic journals and that tested the relationship between board gender diversity and firm financial performance (return on assets, return on equity, and Tobin’s Q).

Klein concludes: "The results of these two meta-analyses, summarizing numerous rigorous, original peer-reviewed studies, suggest that the relationship between board gender diversity and company performance is either non-exist (effectively zero) or very weakly positive."

But, it seems safe to conclude there is no academic case against a more gender equal board. So we can have more women directors for gender equality, societal reflections and positive cultural reasons and NOT impact business. That should be reason enough.

(I will note one recent positive correlational study "Using annual data on over 3000 US firms from 2007 to 2014, we show that the presence of women on the board has a positive effect on firm performance, and this effect varies at different parts of the performance distribution. Critically, we demonstrate that the presence of women directors alters the dispersion of firm performance. " by Conyon (wharton) and He (SUNY) (2016, 2017) This paper also has good references to other papers; but I think the meta-studies carried more statistical weight; you can find some individual positive and negative correlational studies in the literature, but not overwhelmingly pointing in one direction).

If you'd like to feel inspired by commencement addresses and life lessons try: Ursula K Le Guin on literature as an operating manual for life; Neil Gaiman on making wonderful, fabulous, brilliant mistakes; or Nassim Taleb's commencement address; or JK Rowling on the benefits of failure. Or Charlie Munger on always inverting.

Cross fertilise. On investing try a thought on stock valuations. Or Ray Dalio on populism and risk. You can also click on the Carbon tag below.

A lesson from autism here. And a post on the seductive story of Bitcoin

This paper makes for sobering reading on the cost of inequality for lost inventions in the US.

Full paper here. Summary paper here. NYT article here.

“We characterize the factors that determine who becomes an inventor in America by using de-identified data on 1.2 million inventors from patent records linked to tax records. We establish three sets of results. First, children from high-income (top 1%) families are ten times as likely to become inventors as those from below-median income families. There are similarly large gaps by race and gender. Differences in innate ability, as measured by test scores in early childhood, explain relatively little of these gaps. Second, exposure to innovation during childhood has significant causal effects on children’s propensities to become inventors. Growing up in a neighborhood or family with a high innovation rate in a specific technology class leads to a higher probability of patenting in exactly the same technology class. These exposure effects are gender-specific: girls are more likely to become inventors in a particular technology class if they grow up in an area with more female inventors in that technology class. Third, the financial returns to inventions are extremely skewed and highly correlated with their scientific impact,as measured by citations. Consistent with the importance of exposure effects and contrary to standard models of career selection, women and disadvantaged youth are as under-represented among high-impact inventors as they are among inventors as a whole.”

From the NYT:

“Much of human progress depends on innovation. It depends on people coming up with a breakthrough idea to improve life. Think about penicillin or cancer treatments, electricity or the silicon chip.

For this reason, societies have a big interest in making sure that as many people as possible have the opportunity to become scientists, inventors and entrepreneurs. It’s not only a matter of fairness. Denying opportunities to talented people can end up hurting everyone….

…

The project’s latest paper, out Sunday, looks at who becomes an inventor — and who doesn’t. The results are disturbing. They have left me stewing over how many breakthrough innovations we have missed because of extreme inequality. …

I encourage you to take a moment to absorb the size of these gaps. Women, African-Americans, Latinos, Southerners, and low- and middle-income children are far less likely to grow up to become patent holders and inventors. Our society appears to be missing out on most potential inventors from these groups. And these groups together make up most of the American population….

...The groups also span the political left and right — a reminder that Americans of different tribes have a common interest in attacking inequality….

If you'd like to feel inspired by commencement addresses and life lessons try: Ursula K Le Guin on literature as an operating manual for life; Neil Gaiman on making wonderful, fabulous, brilliant mistakes; or Nassim Taleb's commencement address; or JK Rowling on the benefits of failure. Or Charlie Munger on always inverting.

Cross fertilise. On investing try a thought on stock valuations. Or Ray Dalio on populism and risk. You can also click on the Carbon tag below.

Bitcoin has a seductive story. All great investment manias have a compelling narrative behind them, all with a fistful of truth. An early one being tulip bulbs. I still argue Bitcoin is NOT an investment, but a speculation in a maybe-currency. It also is waste of energy (in my view). Bitcoin mining energy, which consumes the same as a medium sized country like Ireland, could be used more productively given the pollution cost emitted.

Still, the mania has further to run, in my view, as although many random people I meet talk about it, there are still many people to be seduced.

Jeffrey Robinson, the author of BitCon, writes that bitcoin is "a digital-something pretending to be a currency; that same digital-something pretending to be a commodity; a political movement that reeks of a delusional cult; and a technology — a unique peer-to-peer transfer system — that happens to be brilliant."

Block chain technology is great. Bitcoin itself, not so much.

But, back to the story…. My early career was as a stock broker - the sell-side - and as all good sell-siders know, selling investments is about selling a story, selling a narrative… indeed politics and much of life today is about the story… “facts” and data are only a small (or even non-existent) part of the debate. Don’t let a fact get in the way of a good story (fakenews).

An early story of being seduce by investment manias involves Isaac Newton of gravity, physics and maths fame. He supposedly said (though my guess this is made up):

“I can calculate the movement of stars, but not the madness of men.”

(Nassim Taleb would agree. Stars and comets and that type of physics are systems we can calculate. Complex systems like markets are beyond us, mix in fat tails and by their nature, black swans, will always be beyond our imagination).

Newton was an early winner then victim of the South Sea China Bubble. See picture above. He made a nice profit, but then went back in and lost it all. Some traders (eg supposedly Soros) can identify bubbles early and exit before the crash, but it’s a rare skill / luck.

So… the bitcoin story… it starts with a legendary mysterious inventor (pen name Satoshi Makamoto), who is unknown, unidentified and has walked away from billions to serve a larger purpose….this purposes inspires those such as this FT reader:

...The internet as we know it would not exist without the government. Crypto makes governments obsolete. Cryptocurrency combines value and governance into one package that obviates the need for nation-states. And it doesn't have to just be used for money; it can be used to decentralize anything that we currently produce or exchange in a centralized way. That is what is exciting here. Not making a bunch of money, or the massive transfer of wealth from the old guard to a bunch of risk taking nerds. The latter is exciting to me because who doesn't like money, but it's much more deeply exciting because our current governments (all of them), while mostly better than what we had before, are a truly awful human system. They tax humanity to make war with each other….

It’s also used by criminals (or any who don’t want to be traced), those who might consider gold a store of value, those who only have access to very unstable currencies.

It appeals to a certain kind of libertarian thinker, it appeals to those who are disillusioned with government (and that’s a lot of people)... and there’s the nub:

It appeals to those who love a good story. And that’s all of us. Economists would do well to remember that.

If you'd like to feel inspired by commencement addresses and life lessons try: Ursula K Le Guin on literature as an operating manual for life; Neil Gaiman on making wonderful, fabulous, brilliant mistakes; or Nassim Taleb's commencement address; or JK Rowling on the benefits of failure. Or Charlie Munger on always inverting.

Cross fertilise. On investing try a thought on stock valuations. Or Ray Dalio on populism and risk. You can also click on the Carbon tag below.

Oh when the wolves (Oh when the wolves) go marching in (Go marching in) Oh when the Wolves go marching in I want to be in that number When the Wolves go marching in....

This was my first time to Wolverhampton and the "Black Country".

Two possible origins of the term Black Country.

(1) the exposed coal seams that run through the country (2) the smokey black fog that was prevalent in the 1800s.

I also learnt the gold and black colours of Wolverhampton Wanderers FC originate from the city's motto 'Out of darkness cometh light', with gold and black representing light and dark respectively.

Many Wolverhampton workers are feeling happy at the moment as they sit top of their football league table (Championship).

And we know happy employees, satisfied employees (better #ESG) make better companies (!) and better stock returns. See Alex Edmans paper.

Listened to the West Midlands Pension Fund AGM and spoke about ESG, stewardship and #responsible #investment.

A topical question was asked on engage / divest conundrums. When a shareholder divests they may no longer influence the board/management. If coal [insert controversial item] assets are divested to a less responsible owner - is the problem solved or made worse?

The discussion revolved around needing both engage and divest prongs at work. Neither alone is as effective together. Discuss.

There is no simple answer, but universal owners such as index funds have a duty to engage; and active managers gain more returns if they do successfully engage - this paper would suggest.

If one puts the active ownership paper together with the work on the outperformance of Global Equity managers described here, one can start to build a defense of Active Management; where John Kay would argue Active Managers should compete on style and philosophyin any case.

If you'd like to feel inspired by commencement addresses and life lessons try: Ursula K Le Guin on literature as an operating manual for life; Neil Gaiman on making wonderful, fabulous, brilliant mistakes; or Nassim Taleb's commencement address; or JK Rowling on the benefits of failure. Or Charlie Munger on always inverting.