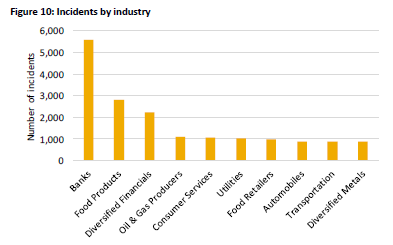

Which sector had the most ESG incidents (2014-16) ? Banks, according to Sustainalytics research.

-Banks account for 19% of all incidents, more than twice the amount of the next most exposed industry (Food Products).

-With an incident risk coefficient of 0.52, the Automobiles industry is the riskiest from a size-adjusted industry perspective.

-Other industries with a high probability of producing incidents include Aerospace & Defense, Precious Metals and Banks.

-Real Estate firms are least likely to get caught up in incidents. Only 26 out of 376 real estate companies (7%) were involved in an incident from 2014-2016.

-Market cap analysis demonstrates that large firms are the most prolific contributors of incidents. Mega-caps produce an average of 106 incidents per firm, compared to 15 incidents per large cap firm, four per mid cap firm and three per small and micro cap firm.

More thoughts: My Financial Times opinion article on the importance of long-term questions to management teams and Environment, Social and Governance capital.

Here is some MSCI research looking at ESG in high return companies.

One of the best Munger speeches on how to think about a mental model of inversion can be found here.

If you'd like to feel inspired by commencement addresses and life lessons try: Neil Gaiman on making wonderful, fabulous, brilliant mistakes; or Nassim Taleb's commencement address; or JK Rowling on the benefits of failure. Or Charlie Munger on always inverting; Sheryl Sandberg on grief, resilience and gratitude or investor Ray Dalio on Principles.

Cross fertilise. Read about the autistic mind here.