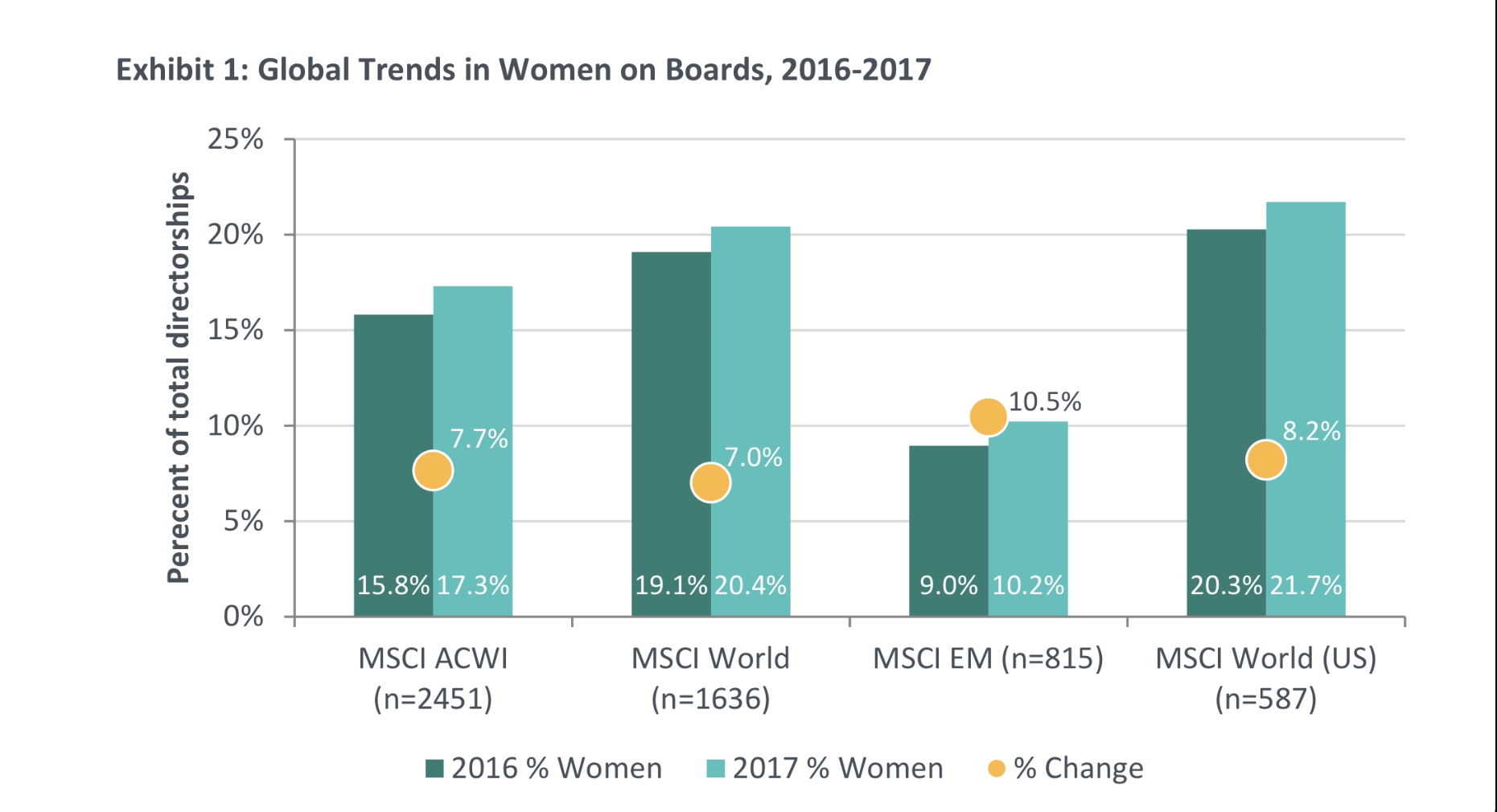

I found these numbers shocking. In the ACWI world index, only 17% women board directors. Only 28 out of 2,541 members of the MSCI ACWI Index (1.1%) had boards consisting of at least 50% women. Only 7 had boards majority female. (My data is from 2017, but this MSCI paper is 2015 data, which is all a little worse)

23% of ACWI have all male boards (as of Oct 2017). That's over 1 in 5 ACWI companies.

Sure, we must focus of equality of opportunity and not necessarily outcome. But, these indicators suggest we still have some way to go.

Is it a surprise we have MeToo when the makeup of people in power are so dominantly men?

Of course, there are other lens to seek diversity of thought and to reflect the fabric of our society. But we can be intersectional and multi-faceted, running ‘identities’ in parallel.

Mother, daughter, girlfriend, sister, partner – we can be all these at once. It is healthy for the boards of the companies of our world, not to better reflect the mix of our world?

A note on academic papers below here

In terms of eg company profits, Peer-reviewed academic data is mixed (despite what certain media and consultant reports might say) made harder as causality/correlation is difficult. There is a good non-technical summary by Katherine Klein (Wharton) here examining two meta-studies (Post and Byron, 2015, 140 studies of board gender diversity with a combined sample of more than 90,000 firms from more than 30 countries) and (Pletzer, Nikolova, Kedzior, and Voelpel (2015) in a different approach, conducting a meta-analysis of a smaller set of studies — 20 studies that were published in peer-reviewed academic journals and that tested the relationship between board gender diversity and firm financial performance (return on assets, return on equity, and Tobin’s Q).

Klein concludes: "The results of these two meta-analyses, summarizing numerous rigorous, original peer-reviewed studies, suggest that the relationship between board gender diversity and company performance is either non-exist (effectively zero) or very weakly positive."

But, it seems safe to conclude there is no academic case against a more gender equal board. So we can have more women directors for gender equality, societal reflections and positive cultural reasons and NOT impact business. That should be reason enough.

(I will note one recent positive correlational study "Using annual data on over 3000 US firms from 2007 to 2014, we show that the presence of women on the board has a positive effect on firm performance, and this effect varies at different parts of the performance distribution. Critically, we demonstrate that the presence of women directors alters the dispersion of firm performance. " by Conyon (wharton) and He (SUNY) (2016, 2017) This paper also has good references to other papers; but I think the meta-studies carried more statistical weight; you can find some individual positive and negative correlational studies in the literature, but not overwhelmingly pointing in one direction).

If you'd like to feel inspired by commencement addresses and life lessons try: Ursula K Le Guin on literature as an operating manual for life; Neil Gaiman on making wonderful, fabulous, brilliant mistakes; or Nassim Taleb's commencement address; or JK Rowling on the benefits of failure. Or Charlie Munger on always inverting.

Cross fertilise. On investing try a thought on stock valuations. Or Ray Dalio on populism and risk. You can also click on the Carbon tag below.

A lesson from autism here. And a post on the seductive story of Bitcoin